Gross advertising market in the DACH region grows slightly

Media Focus Switzerland, Nielsen Germany and Focus Austria have analyzed developments in the advertising market in the DACH region for 2023. One company in particular stood out with a strong market position in all three countries.

Media Focus Switzerland, Nielsen Germany and Focus from Austria have analyzed the developments on the advertising market in the DACH region for 2023. In addition to gross advertising pressure, the analysis includes figures on trends compared to the previous year, spending by the top three advertisers in the respective countries, the top motifs according to advertising pressure and the top advertising drivers.

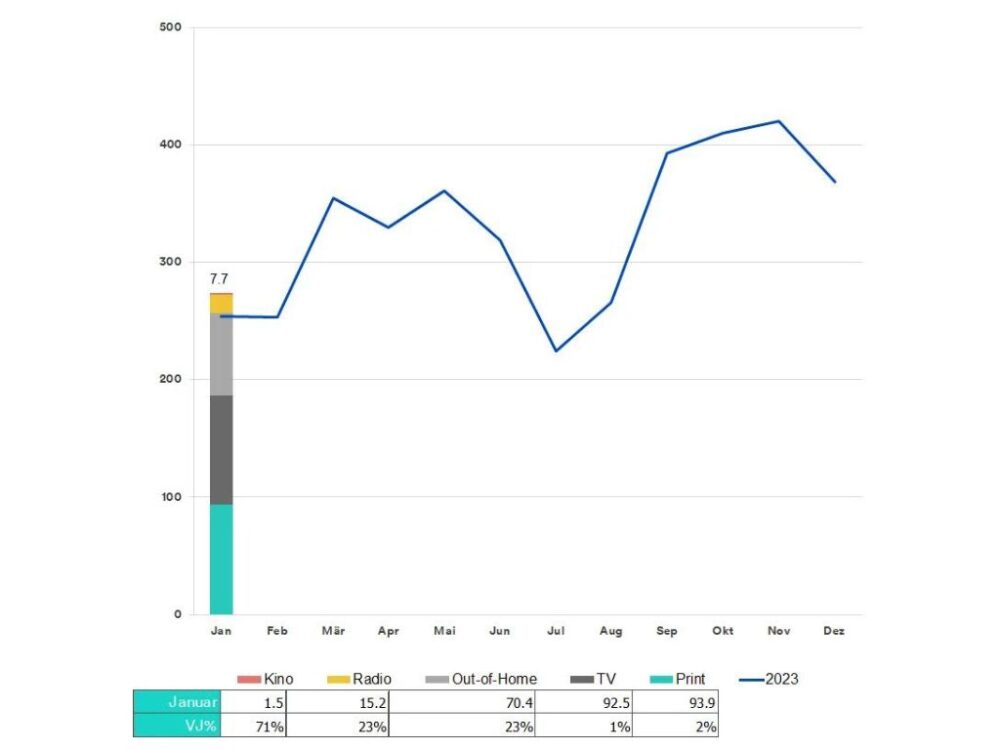

Gross advertising pressure for the D-A-CH region amounted to EUR 42.5 billion in 2023, which corresponds to a minimal increase of 0.6% compared to the previous year. This increase was supported by the positive development in Germany (+1%), while advertising pressure declined in Switzerland (-1%) and Austria (-0.9%). With the exception of TV, all media groups increased their advertising pressure. Germany spends the least per capita: 409 euros. In Austria it is EUR 445 and in Switzerland EUR 483.

The top advertisers in Switzerland in 2023 were Coop, Migros and Procter & Gamble, followed by Ferrero and L'Oréal. Procter & Gamble's presence in the top advertisers in all three countries is striking, a sign of its strong market position in the entire D-A-CH region. While Lidl and REWE are among the top companies in Germany and Austria, other retailers dominate in Switzerland with Coop and Migros.

The top motifs by gross advertising pressure in Switzerland came from Pampers (P&G), Persil and Vicks VapoRub:

The biggest advertising drivers in Switzerland in 2023, i.e. those that have increased their advertising pressure the most, include Jumbo, Beiersdorf, Henkel, Ikea and Unilever.

The advertising presence of companies is measured in gross advertising pressure. This is the equivalent value according to the media rate for the individual placement and not the actual expenditure, costs or budgets. Volume discounts, customer or special conditions are not taken into account. A whole range of other media channels are available in the individual countries - particularly in the online sector (search, YouTube, SoM). In order to ensure comparability between the countries, the highest common denominator was chosen for the harmonization of the data worlds.