How the coronavirus is changing the Swiss retail trade

The coronavirus is currently dominating the economy, media reports and the everyday life of the population. Nielsen has investigated the impact of the global pandemic on the Swiss retail trade.

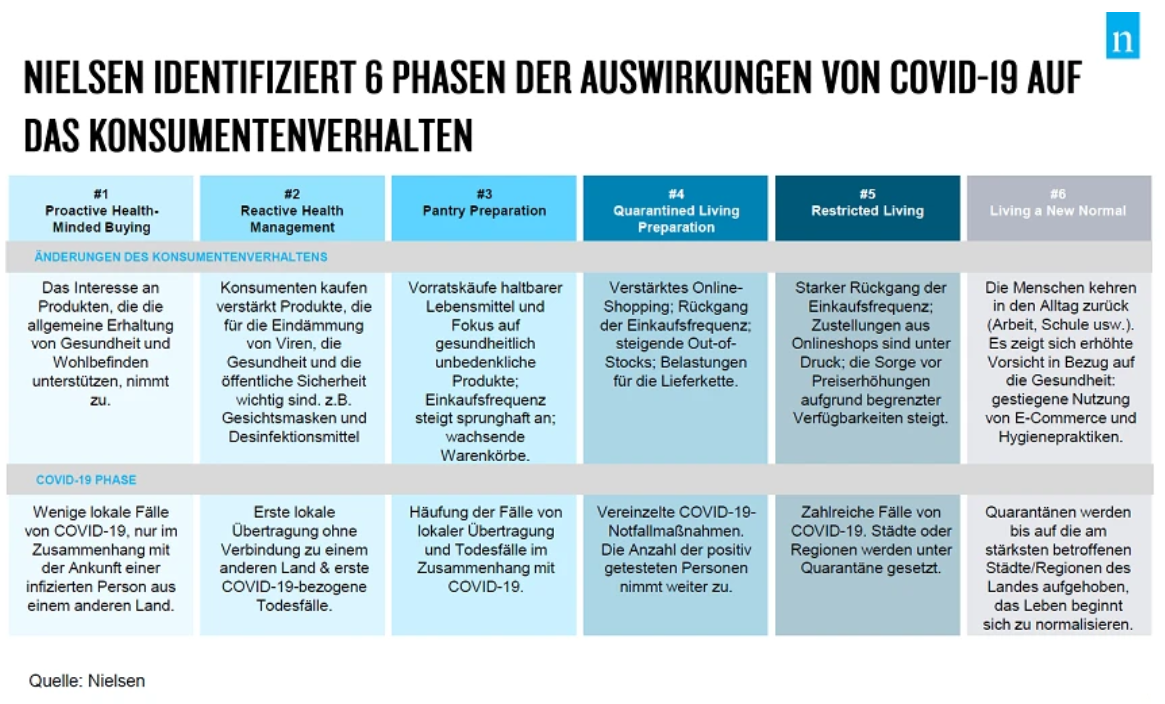

Nielsen Global Connect identifies six phases of consumer behavior directly related to key events surrounding the novel coronavirus (COVID-19) outbreak. The phases reveal early signals of purchasing behavior, particularly for stockpiling and healthcare products. A pattern is emerging here that is reflected in several countries around the world.

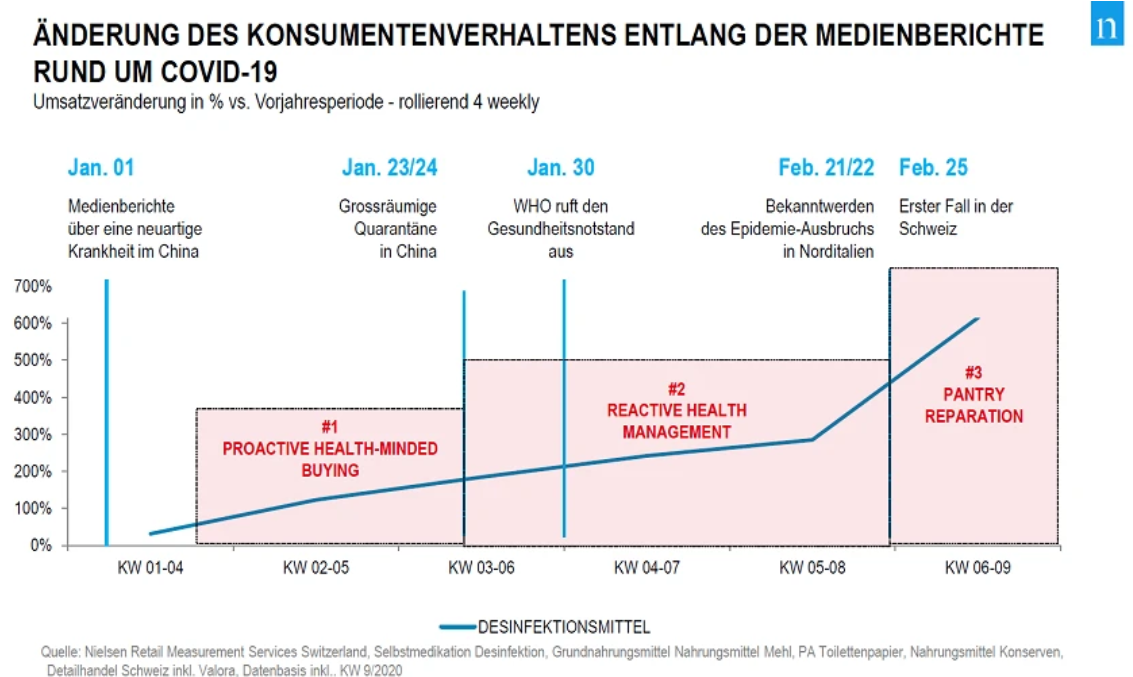

Specifically, a correlation can be observed between, on the one hand, coronavirus media reports and government measures to contain the pandemic and, on the other hand, changes in purchasing behavior for numerous product groups such as hygiene & health products, care products and non-perishable foods.

The phases are linked to key events in the course of the pandemic in the respective country. The following graphic shows an overview of the six phases and what they mean for food & drug retailers.

The impact on the Swiss retail trade

For Switzerland, too, we have examined the correlations between these phases and developments in food and drugstore retailing. The chart below shows that consumers in Switzerland react in a similar way to other countries.

Even before the first cases occurred in Switzerland on February 25, Swiss consumers began to stock up on the consumer goods that were important to them. The initially elevated growth rates at the beginning of the year are explained by postponed holiday shopping. Initial reports of a novel virus in the first week of the calendar are likely to have had little or no impact in Switzerland.

Following an analysis of the impact of the pandemic on global consumption (Pandemic Pantries), particularly in China, Italy, and the United States, a consumer response to the further spread of COVID-10 was identified. Increased hand sanitizer sales were the first indication of a change in behavior. This is followed by a spiral of precautionary purchases.

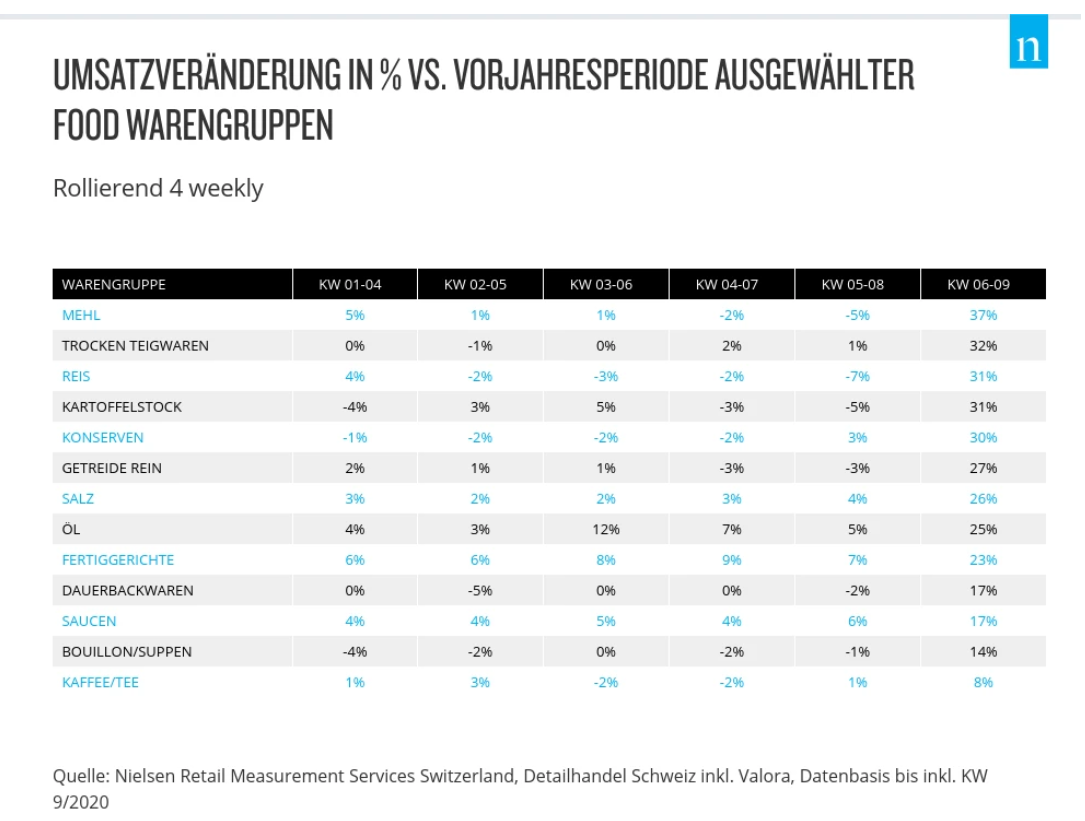

When looking at stockpiled items that consumers frequently replenish in "emergencies" (especially toilet paper, flour, rice, canned goods, etc.), no large impact was seen in the first eight weeks of the year. However, given the increase in distribution from calendar week 9 onwards, a sharp rise in locally increased purchasing behavior is evident.

In terms of food product groups, there were strong gains in calendar weeks 6-9, particularly for storable foods. These include flour, pasta, rice, mashed potatoes and canned goods. However, products such as salt, oil, mineral water and sauces also showed a positive development, although less so than the basic foodstuffs.

Product groups such as frozen products, sweetened spreads and cheese are showing a lower growth rate compared to the above categories - these are apparently seen by consumers as complementary rather than essential.

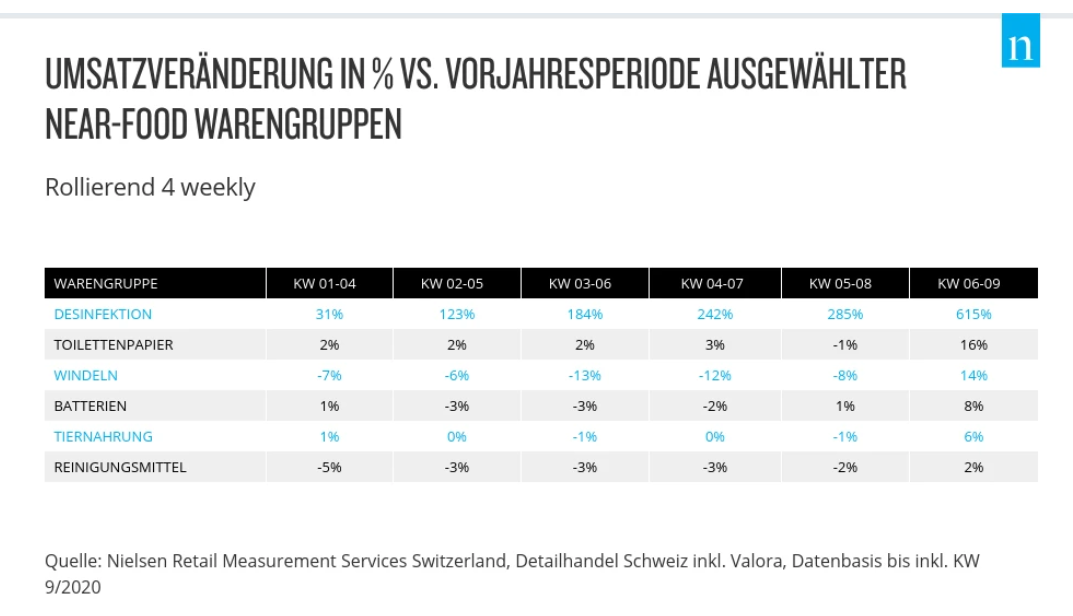

Nielsen sees similar developments in the near-food sector. In calendar weeks 6-9, stockpiling purchases of important daily consumer goods followed in line with the trend. Disinfectants have already shown disproportionate growth since January. Other items such as toilet paper, diapers, batteries and pet food are picking up strongly, especially in recent weeks

"COVID-19 evolved very quickly from happening "far away in other countries", to a real threat to Switzerland. By following predictable patterns seen in other markets, we can better prepare for the weeks ahead. We will report regularly on retail developments in this exceptional situation," said Sigrid Göttlich, Commercial Leader, Nielsen Connect Austria and Switzerland.