Advertising statistics: sales up again

Revenues in the Swiss advertising industry increased slightly again in 2022, but pre-pandemic levels have not yet been reached. A lot of money went to global tech platforms, for which revenues were estimated.

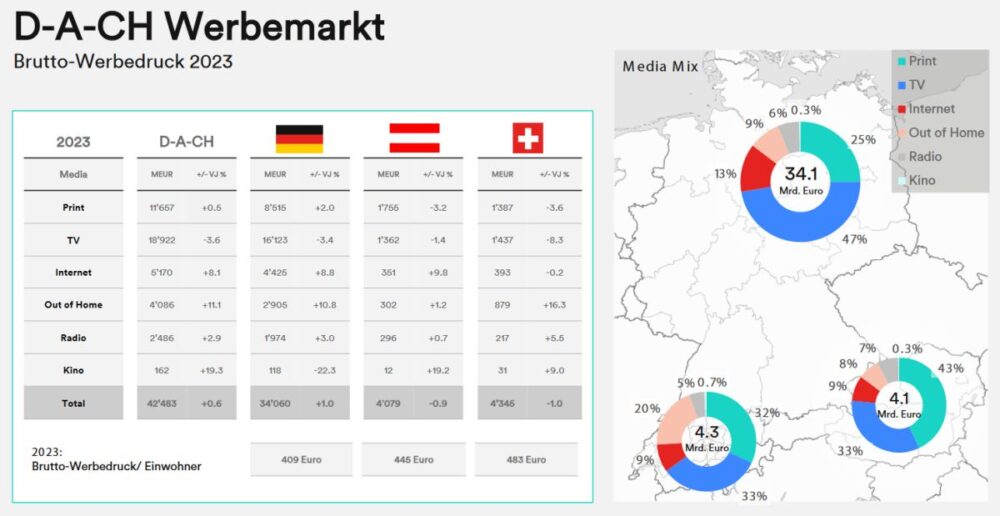

Despite the increase in net advertising sales, the level of 2019, i.e. before the pandemic, was not quite reached again. Overall, 2022 sales are 6.2 percent lower than 2019. Compared to 2021, some media categories increased their sales. For example, cinema (+71.6 %), advertising and promotional items (+26.6 %), outdoor advertising (+17.1 %), radio (+7.1 %) and online (+4.8 %) all saw growing advertising revenues. Press (-0.8 %), TV (-2.3 %) and direct mail (-2.6 %) show a slight decline. Cinema advertising accounts for the smallest share of advertising revenues in Switzerland, with a share of 24 million (2.7%).

Looking at the developments in gross domestic product (+2.1 %) and net advertising sales (+6.3 %), both show an increase. However, advertising sales recorded a greater increase than GDP.

Tech platforms with expert estimation

The media categories that generate the most advertising revenues include press, direct mail and promotional items. Although both press and direct mail lost some ground, they have one of the highest shares this year. Genres such as TV and online also receive a high share of sales. In the case of online advertising, however, the revenues of the global tech platforms and thus the outflows abroad are not taken into account for methodological reasons. To address this absence, this year's publication is the first time that a sound expert estimate has been made. The estimated sales in the areas of

Youtube, search engine advertising and social media total CHF 1.69 to 2.07 billion, making online the clear number one in an overall view.

For the Swiss Media Publishers Association, this is cause for criticism - because the enormous share of the tech giants (around 30 percent of total advertising sales in Switzerland and 74 percent of online sales) makes it clear how high the influence of global tech platforms is on the Swiss advertising market and what a significant share of advertising spending is being removed from the value chain of the Swiss market.

According to the association, the financing of journalism is also suffering considerably as a result: While the advertising revenues of Swiss media companies continue to finance journalistic activities to a significant extent, not a single franc of the advertising revenues of the tech platforms flows back into the financing of journalistic offerings.

It has been proven that the journalistic content of Swiss media companies in particular also provides substantial value for the business model of the digital platforms: The current, well-founded and credible information increases, among other things, the attractiveness and quality of the tech platforms as well as the trust in their services.

The Publishers Association has long been calling for today's copyright law to be adapted to digital developments and the international standard. The ancillary copyright creates a fair balance between the tech platforms, which earn high revenues from the editorial content of the media houses, and the media, which bear the journalistic effort behind it.