The 2020 European Championship pushes the Swiss TV advertising market

The advertising month of June closes with a value of 430 million gross francs. Compared to the previous year, which was hit by Corona, it can thus record an increase of 6.4 percent, but the value is still slightly behind that of 2019 (-5.5%), as Media Focus' Advertising Market Trend shows.

The 1st advertising half-year 2021 closes with 2,340 million gross Swiss francs. The advertising market is thus 0.4 percent behind the figure for the previous year and as much as 19.4 percent behind the figure for 2019.

The flattening of advertising pressure in June heralds the summer slump again in 2021, as usual, but the European Championships with expensive advertising space will boost the Swiss TV market and flatten the decline somewhat.

In the past exceptional year, the advertising presence curve showed a steep upward trend again after the 1st lockdown. With the Olympic Games approaching, it remains to be seen how strong the summer slump will be in 2021.

Advertising pressure in the overall market

Development of advertising print as of June 2021 in millions of gross Swiss francs

Two-thirds of the sectors are picking up again

13 sectors were more active in June and increased their advertising pressure. The media sector shows a significantly stronger advertising performance in June (+107.7%). However, a look at the YTD value shows that the sector is still one of the three sectors with the greatest reduction (-25.4%).

The picture is similar for transit agencies, which are up 86.7 percent in June but are further behind YTD (-23.6%).

In absolute terms, the food industry must also be mentioned at this point. It is the second most visible sector YTD, with an advertising print of CHF 256.2 million and a current increase of 15.8 percent. In June, the percentage increase is even stronger at 26.9 percent. The biggest trigger here is the chocolate + confectionery product group, which also includes the second most advertised product in June, Kinder Bueno. As the retail trade is reducing at the same time (-3.2%), the gap to the sector at the top of the ranking is melting away.

Advertising winners in June also include tobacco (+77.2%), energy (+46.1%) and cosmetics & personal care (+44.4%), all of which also increased YTD. YTD, a total of 13 sectors are above the value from the previous year.

Telecommunications records highest decline

In June 2021, eight industries are reducing their advertising pressure, four of them by double digits. However, only three of these industries are behind their half-year figure from the previous year. Telecommunications (-29.1%) shows the most significant decline, reducing its advertising print by almost one-third in June. YTD, however, the industry is slightly above last year's figure (+3.3%).

Services (-19.6%) also spiral back in June, as it did in May, and are also well behind YTD (-21.7%).

In addition, Vehicles (-18.0%), Construction, Industry, Furnishings (-15.3%), Pharmaceuticals & Health (-9.1%), Retail (-3.2%), Fashion & Sports (-1.4%) and Cleaning (-0.3%) are reducing.

Top of the month

Top advertisers and most advertised products and services (excluding assortment, image advertising and collective categories) in June

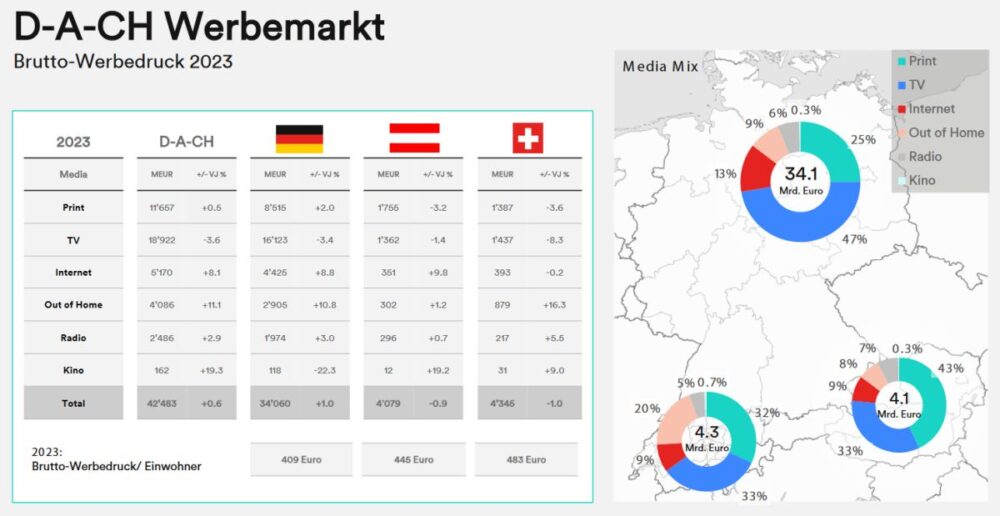

Media Mix

Media Mix for the month of June