Advertising Market Trend: May with New High for the Year

According to the latest Advertising Market Trend from Media Focus, May closed with 455.1 million gross impressions, a significant increase of 30.8 percent over the previous year. Compared to the previous month, gross print also increased by 10.3 percent, and May thus replaced March as the month with the highest advertising print to date. Compared to 2019, however, the Corona consequences continue to show with a minus of 13.1 percent.

Cumulatively, annual advertising print is 1.9 billion, just 1.8 percent behind 2020, but still well behind 2019 (-22%). 17 of 21 industries are reducing advertising print, in some cases drastically, compared to 2019. The largest percentage declines are in events (-74%), transportation (-65%), leisure, hospitality, tourism (-57%) and media (-46%).

The only beneficiaries of the crisis are the cleaning industry (+33%), tobacco products (+17%), retail trade (+12%) and food and initiatives and campaigns (+2% each).

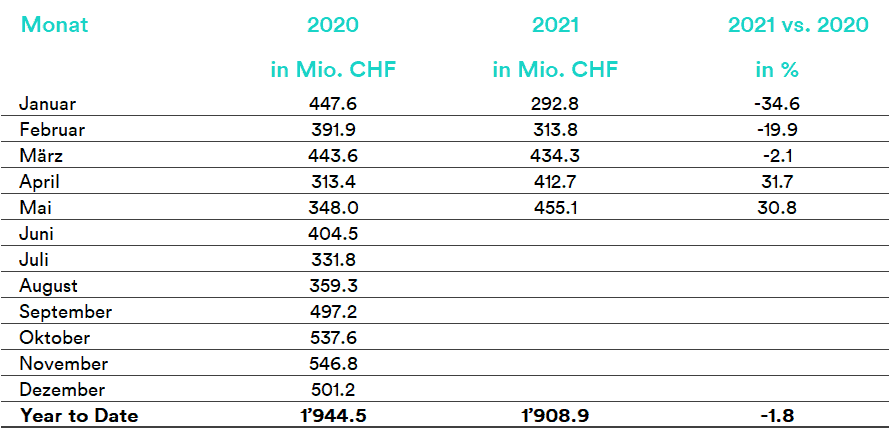

Advertising pressure in the overall market

The development of advertising print as of May 2021 in millions of gross Swiss francs.

Slow steps back to normality

After the event industry revived anticipation for concerts, exhibitions, sporting events and the like with a significant increase in April (+87.4%), it can again increase considerably in May (+191.7%). Whether art & culture, sports or business. Advertising pressure is increasing significantly compared to the previous year. Last but not least, Switzerland's largest advertiser, Coop, contributes to the growth in the industry with its "Day of Good Deeds". However, a look into 2019 - pre-Corona - shows that this plus should not be overestimated, as the 2-year development is clearly negative at minus 63 percent.

Furthermore, of the top 10 industries by advertising pressure, Cosmetics & Personal Care (+76.4%), Initiatives & Campaigns (+67.0%), and Fashion & Sports (+44.5%) increase by over a third. Cosmetics & Toiletries in particular is surprising, with advertising pressure even 4.7 percent higher than in 2019. Fashion & Sports, on the other hand, suffered a decline of 21.9 percent compared to 2019. Initiatives & Campaigns is being boosted by the political campaigns in view of the June 13 referenda and the FOPH's Corona campaign.

Only slight year-on-year declines

Only three sectors slightly reduced their advertising print compared with the previous year. The biggest decline was recorded by the cleaning sector (-11.7%), which was still able to increase its advertising print by 75.4 percent year-on-year in 2020 and is actually one of the winning sectors compared with 2019 (YTD).

Media also reduced its gross ad print by 7.8 percent in May, trailing YTD gross ad print by 41.5 percent.

The last industry in the round is services. However, this only lowers advertising pressure slightly in May, by 4.9 percent, compared with 2020.

Top of the month

Top advertisers and most advertised products and services (excluding assortment, image advertising and collective categories) in May