Swiss advertising market closes 2020 down 14 percent

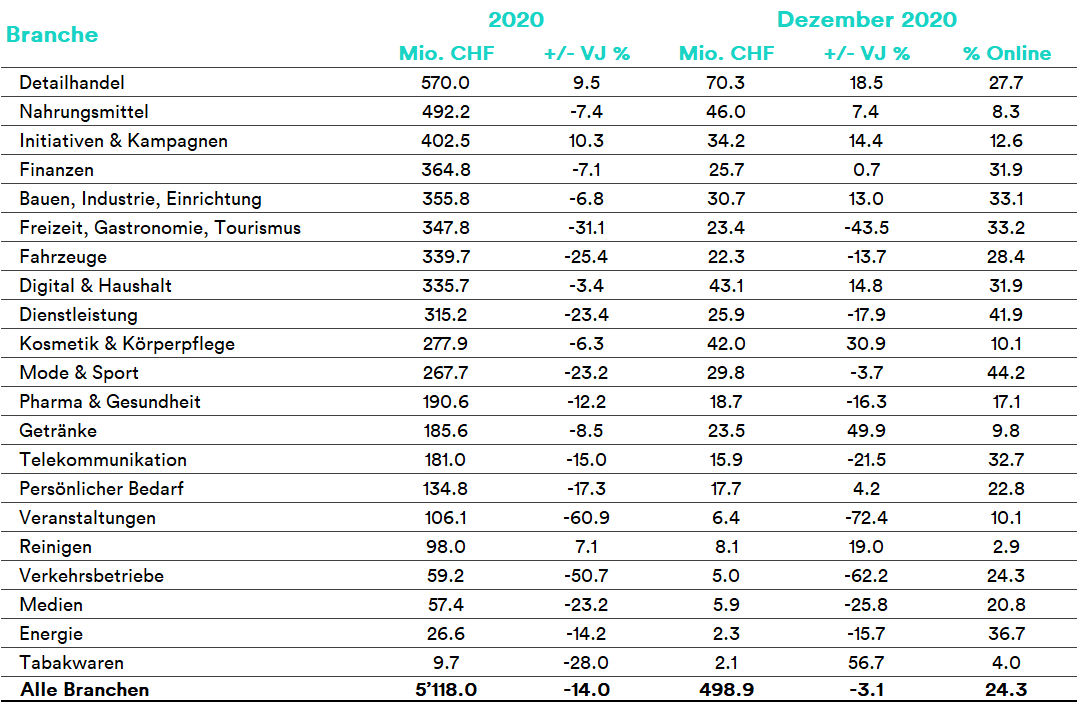

The annual figures for gross advertising print statistics in Switzerland for 2020 show that advertising print in December, at 499 million, only just missed the 500 mark and is only -3.1 percent below the previous year's figure. The advertising print for 2020 in the Swiss advertising market thus comes to 5.2 billion gross advertising francs.

5.2 billion gross advertising francs corresponds to a drop of around 835 million or 14 percent. Initial forecasts after the first lockdown in the spring had painted an even bleaker picture for the future of the Swiss advertising market.

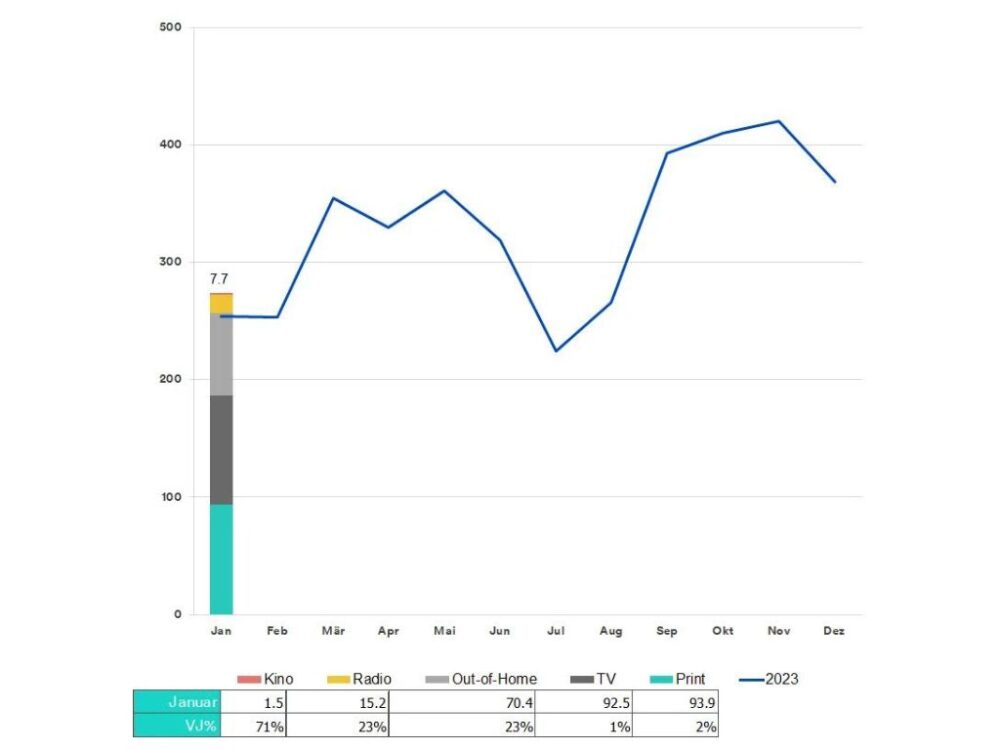

The three months from March to May 2020 were more than 30 percent behind 2019 levels, explaining about 500 million of the decline in gross advertising print in Corona's 2020 year. The largest percentage decline was in April (-40%). March was down 33 percent.

However, the situation eased slightly in the months that followed. The initial uncertainty was overcome, processes and content were adapted, campaigns launched, and the decline leveled off at around 10 percent of the previous year's figure. In particular, the top 20 advertisers, who are responsible for around 25 percent of total advertising pressure (2020: around 30,000 active WBT), released the handbrake in June and in some cases even stepped on the gas significantly, which weakened the overall decline. In June, July and August - the summer slump in the advertising industry - they increased their advertising pressure by 12 percent compared to 2019, kept the pressure high in the fall and even recorded an increase of 22 percent in the last month of the year.

In addition, out-of-home advertising proved extremely resistant to the crisis. After a delayed slump in April, the media group was only slightly below the previous year's level in June and was even the only media group to post significant growth over the summer into the fall (+8% to +26%).

Crisis winners vs. crisis losers

Only three of the 21 sectors were able to increase their advertising pressure compared with the previous year. On the one hand, this is the retail trade, which also generated by far the highest advertising pressure in 2020 (+9.5%). On the other hand, the Initiatives & Campaigns sector, which was boosted by the FOPH's Corona campaign and the referendums (+10.3), and last but not least the Cleaning sector (+7.1%). But if we look one layer deeper into the individual product groups, even more markets stand out. Of 120 product groups, around a third increased their advertising print year-on-year. Around 20 percent even increased by more than 5 percent. These included TV & home entertainment, Internet, nutritional products, pension and investment products, gardening, tobacco products image, media image, spirits, hair removal & shaving, and household appliances.

The list of losers in 2020 is long. More than half of the sectors are reducing their advertising pressure by double digits. Beverages, food, finance, construction, industry, furnishings, cosmetics & body care, and digital & household are getting off comparatively lightly.

The worst hit is the event industry (-60.9%), followed by transportation (-50.7%) and leisure, catering, tourism (-31.1%). Here, considering the December data as well as the current second lockdown, there is no improvement in sight yet either.

Others show a fighting spirit in December: Tobacco Products (+56.7% to -28%), Personal Care (+4.2% to -17.3%), Beverages (+49.9% to -8.5%), Food (+7.4% to -7.4%), Construction, Industrial, Furnishings (+13% to -6.8%), Cosmetics & Personal Care (+30.9% to -6.3%), and Digital & Household (+14.8% to -3.4%) all rebound in December (Dec vs. 2020). With the second lockdown, it remains to be seen if this trend is sustained.

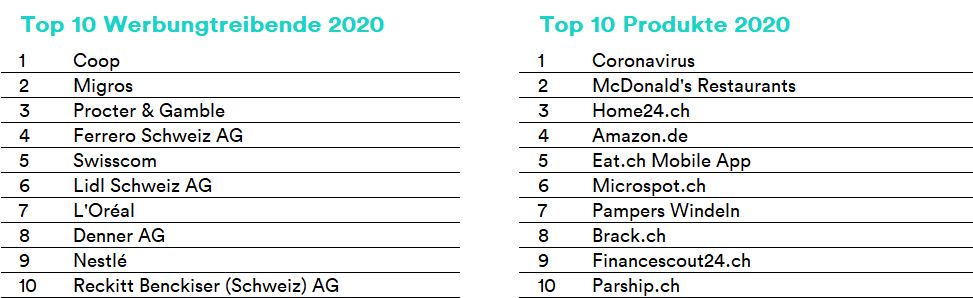

FOPH corona campaign at the top

The podium places of the strongest advertisers go to Coop, Migros and Procter & Gamble. This is just as true for 2020 as a whole as it is for the month of December. With Henkel, Unilever and Emmi, there are only three companies in the December ranking that did not make it into the overall 2020 top 10. On the other hand, the two retailers Lidl and Denner as well as Reckitt Benckiser dropped out of the top 10 in the last month of the year.

The FOPH's coronavirus campaign is the most advertised product in the Swiss advertising market, both in the current month and over the year as a whole. Looking at the remaining top 10 products in 2020, it is noticeable that they come from heterogeneous sectors. However, they have two things in common: on the one hand, they reflect people's basic needs, especially in times of crisis - food, love, financial security and hygiene. On the other hand, they show which business and distribution channels are crisis-proof.

TV as the strongest media group

All media groups lost advertising pressure in 2020. However, the percentage declines are in some cases far apart. Cinema advertising, in some cases non-existent, declined by 73 percent in 2020. At the other end is out-of-home advertising, with a decline of only 7 percent.

TV advertising generates the highest advertising pressure in the Swiss market in 2020. In December, the TV advertising print is even above the previous year's value (+7%). However, like print and radio, the media group reaches its highest value in November, the month with the highest overall advertising pressure. (Werbewoche.ch reported). With a decline of 14 percent, TV is average for the year as a whole. Print advertising takes the second-largest share of the media mix, followed by the Internet, out-of-home, radio and cinema. What is striking in December is the shift between TV and out-of-home. While TV is gaining, out-of-home is losing share.