Swiss advertising market scratches 500 million mark

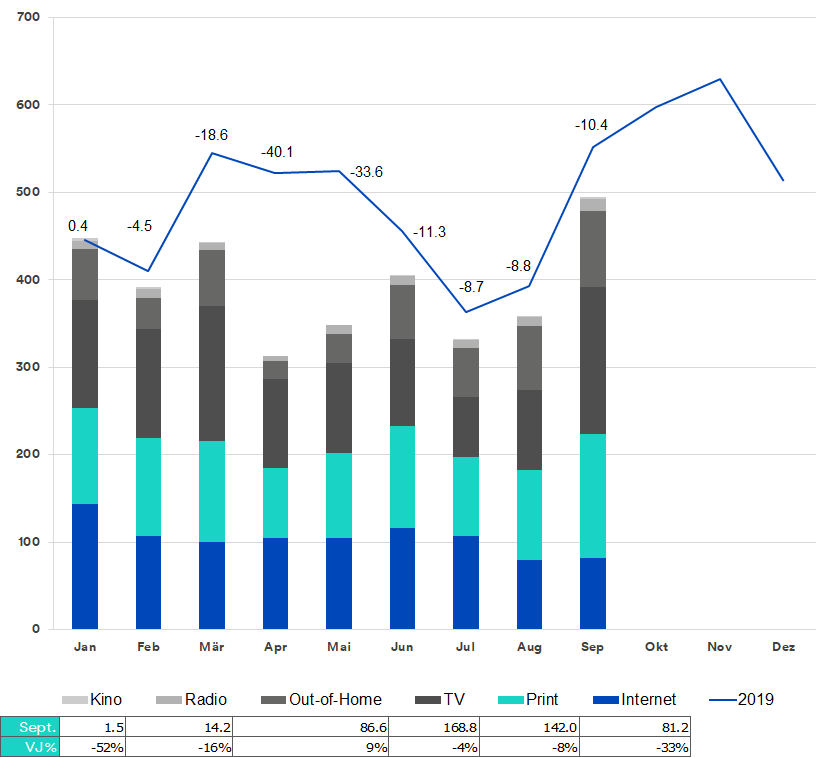

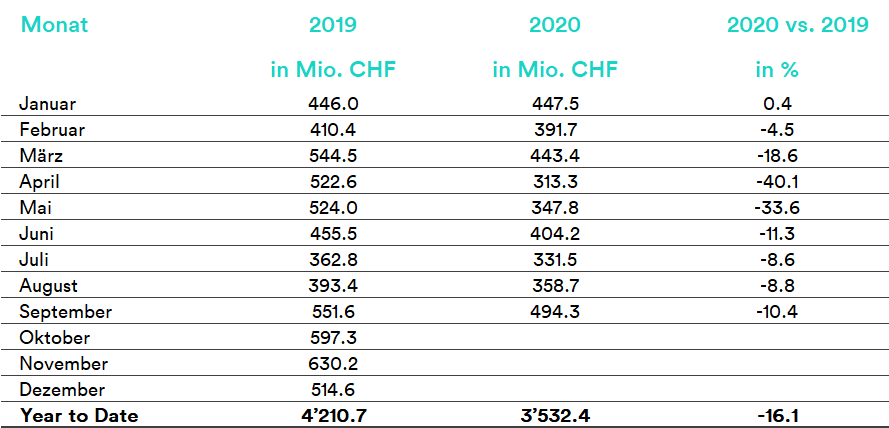

September, which is normally a very strong month for advertising, was once again the strongest month of the first three quarters of the year - despite the Corona crisis. At 494.3 million gross Swiss francs, advertising print in September only just scraped past the 500 million mark. Nevertheless, the situation remains tense.

After the summer slump, the curve is now pointing steeply upwards again for the first time - 135.6 million more or 37.8 percent increase compared to the previous month of August. However, the year-on-year comparison remains sobering. All media groups, with the exception of out-of-home, continue to lag well behind the previous year's figures.In view of the rising infection figures and increasing uncertainty, it remains to be seen how the market will develop. Overall, the gross value print in 2020 so far amounts to 3.5 billion. A decrease of 16.1 percent compared to the previous year.

OOH advertising continues to gain ground

While all media groups continued to struggle with declines, some of them significant, in September compared to the previous year, out-of-home set another scent mark with a renewed year-on-year increase of 8.9 percent. Digital out-of-home in particular is posting consistently high growth rates, as it did before the Corona-related slump in April and May. Compared to September 2019, this is 42.5 percent. July and August even saw an almost doubling of advertising print. But analog out-of-home advertising also continues to grow, albeit at a lower level (September: +2.7%; August, +14.9%). Looking at the year as a whole, however, out-of-home also fails to match the advertising print of the previous year, losing 8.8 percent.

TV and print advertising again with moderate percentage losses in advertising print. TV loses 4 percent compared to 2019, print 8 percent. The general-interest, financial and business press can even increase slightly (+1.2%). However, this is driven by newspaper supplements and not advertisements in newspapers. The decline of radio is higher in September than in August (-16% to -6%). Cinema continues to be the medium most affected by the Corona crisis.

However, it can be noted positively in September that advertising print almost doubled in a month-on-month comparison and the year-on-year declines were slightly smaller (-52% to -67%). Internet advertising remains without a September push and with only a slight month-on-month increase (+2.8%).

One-third of sectors grow year-on-year

In September, seven out of 21 industries are able to increase advertising pressure year-on-year. The retail industry, which not only accounts for 3 of the top 10 advertisers but also the top product this month, recorded the highest percentage increase of around 30 percent and remains the industry with the strongest advertising print YTD.

In the monthly view, however, it is the food sector that takes pole position despite a decline compared to 2019 (-7.2%). In percentage terms, Digital & Household grows the third most (25.1%). Tobacco (+15.1%), Pharma & Health (+14.8%) as well as Initiatives & Campaigns (+13.4%) and Cosmetics & Personal Care (+12.9%) are also growing in double digits.