Industry indicator 2020: Advertising clients expect stable growth

In the fall of 2019, Leading Swiss Agencies (LSA) and the Swiss Advertising Clients Association (SWA) examined the most important indicators of the Swiss communications industry for the second time. In the process, advertising clients were asked about their assessments of the market.

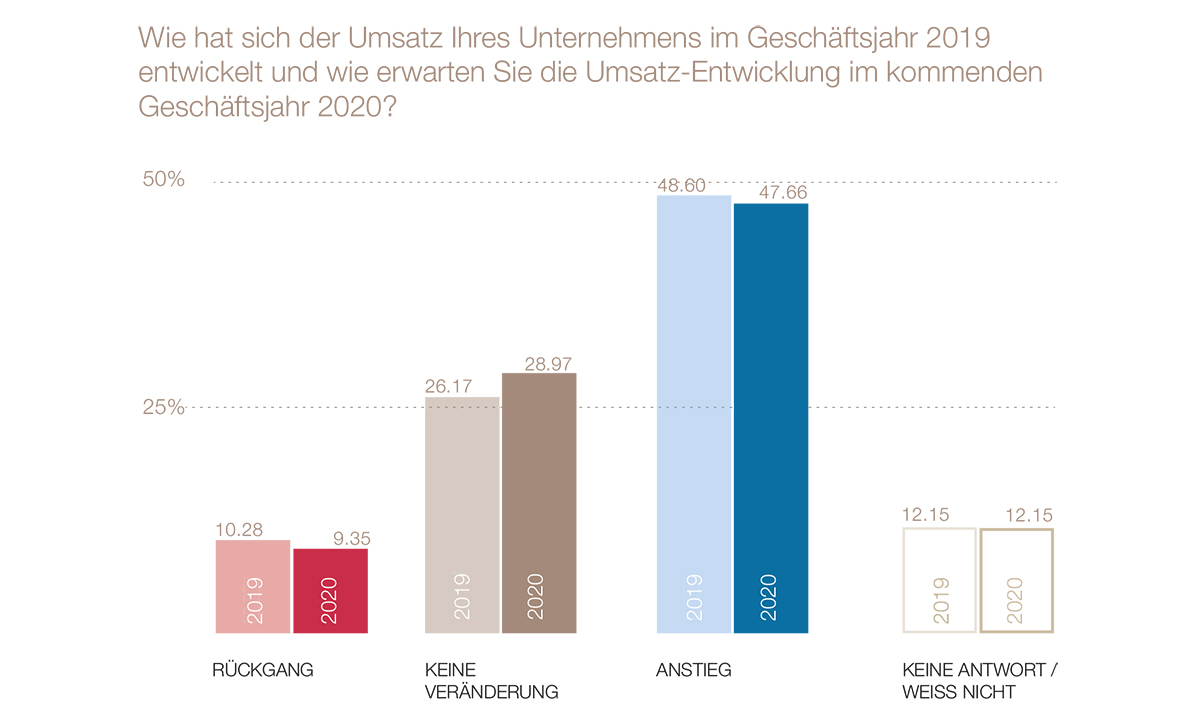

The advertising industry is also reporting stable revenue growth in 2019. Just under half of all respondents (48.6%) report an increase in company sales. Only just ten percent report a decline, while 26 percent announce no change.

The outlook for 2020 is somewhat more restrained, but still similarly optimistic: 47.6 percent of the leading advertising clients expect a positive sales trend. At the same time, communications budgets will remain stable: 45.3 percent expect no changes, 26.4 percent will increase spending on communications, and 25.5 percent expect a decrease. Developments in media budgets also follow a similar pattern.

Traditional media lose ground slightly

In the current survey, advertisers were asked about their "Overall Spendings" in the various media types. In traditional media, most of the respondents want to invest about the same amount of advertising money or about a third less. Only in billboard advertising (OOH), driven by digital advertising spaces in public spaces, do many want to invest the same amount or a third more.

A further strong surge in investment is again expected in online media. SEA, social, online videos and display advertising are expected to improve the reachability of target groups even further. However, the investment volume must be put into perspective in relation to TV advertising, as the volumes in the classic area are still greater.

Voice, meanwhile, has not yet been able to fully establish itself in Switzerland: Amazon has been a major driver in this respect in other markets. This is still missing here. Another obstacle is the lack of voice controls that are compatible with our dialects.

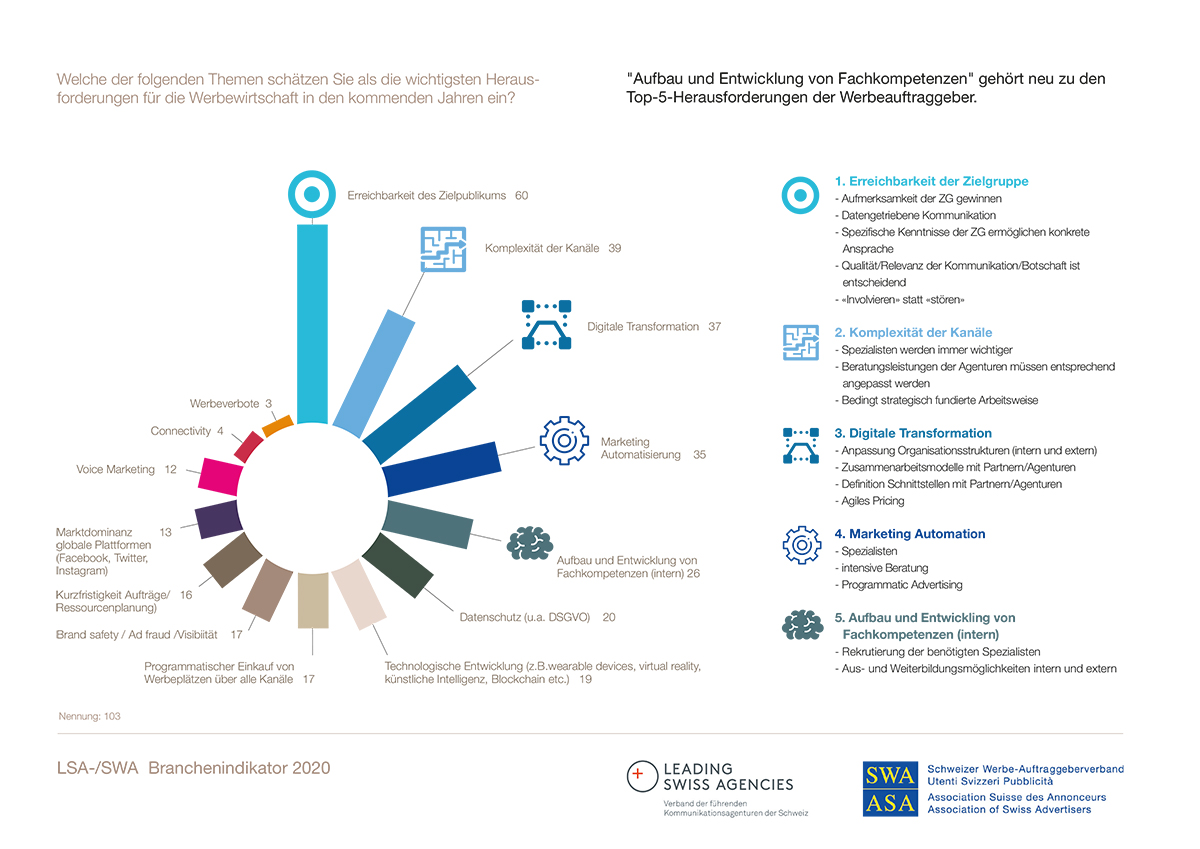

Top challenge: Reaching the target groups

As in previous years, the accessibility of target groups (60%) remains in first place among the top challenges for the advertising industry. Closely linked to this, the next ranks are channel complexity (39%), digital transformation (37%), marketing automation (35%) and building and developing expertise (26%).

This continuing trend can be explained by the fact that the digital transformation is still in full swing. The crucial factor here is that an ecosystem is created in which target group and customer data can be effectively analyzed and used for a targeted customer approach. Mastering this complexity and finding the right mix for successful, data-driven communication requires a great deal of specialist knowledge.

Interpersonal fit for successful cooperation

The most important sources of information in the search for an agency partner continue to include recommendations, contacts with agency management, and agency websites. Finally, from the perspective of the advertising client, the central criteria for the concrete selection of an agency are its personality or qualifications as well as the competencies of the employees.

From the customer's point of view, successful long-term collaboration requires efficient project management, mutual understanding and a high level of commitment. These results map the modern forms of cooperation.

Agile pricing gains importance again

For communications agencies, the "scope of work" is the dominant fee model, which includes a clear project definition and the corresponding agency effort. The majority of media agencies still charge on the basis of a percentage of the media volume and on an hourly basis. Agile pricing continues to gain relevance among communications and media agencies due to new, flexible forms of collaboration between client and agency.

Industry Indicator 2020 Factsheet Download

The Industry indicator was published for the second time by SWA and LSA. 167 well-known advertising clients took part in the annual survey. The survey was conducted between October and November 2019. The detailed results can be obtained from the offices of the two associations.