Swiss entertainment and media market recovers quickly from the crisis

Der aktuelle Bericht «Swiss Entertainment & Media Outlook 2021-2025» von PwC beleuchtet die Auswirkungen der Ereignisse des letzten Jahres und prognostiziert die weiteren Entwicklungen bis 2025.

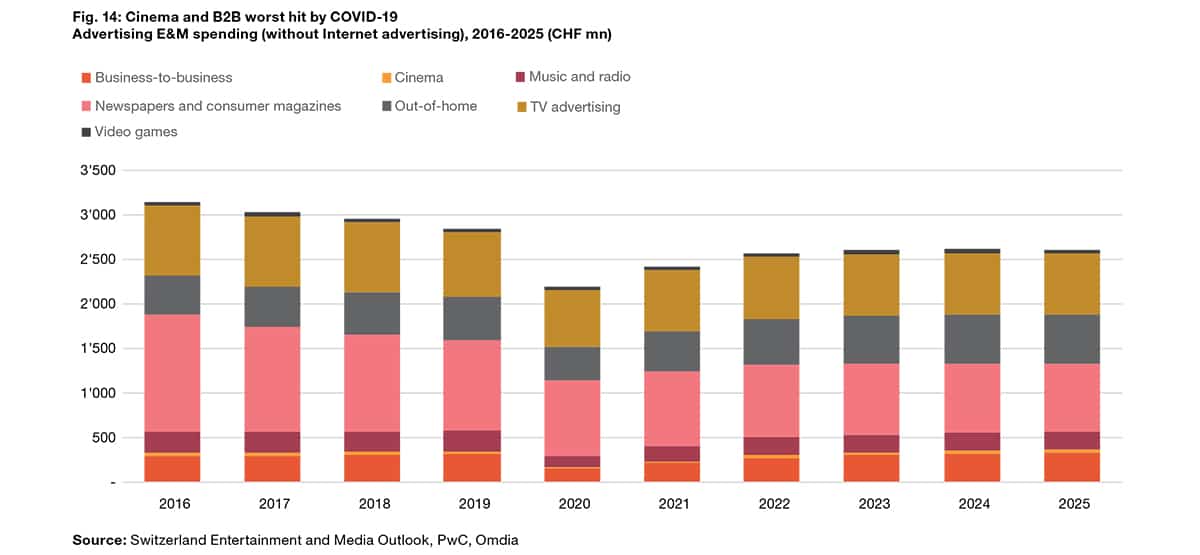

(-65.5 percent) and radio and music (-32.9 percent). By contrast, over-the-top offerings and video games benefited, with revenues up 34.6 percent and 15.6 percent, respectively.

These sectors will grow steadily after the pandemic, while cinema and music and radio are already expected to show exceptional growth of over 20 percent this year. The E&M sector is thus proving to be extremely resilient, even in comparison with other European countries and the Swiss economy as a whole. Both the latter and the E&M sector are recovering quickly from the crisis, with E&M revenue growth culminating in an increase of 5.3 percent in 2022 and then steadily approaching pre-pandemic growth levels until 2025.

Print revenues continue to decline

Nearly two-thirds of E&M revenues come from consumer spending. These fell by 2.2 percent last year, but are already rising again in 2021 and will generate revenues of CHF 13.6 billion in 2025. B2B revenues were less affected by COVID-19, falling by 1.6 percentage points. In the long term, revenues will continue to decline, due to the ongoing shift from print to online. Finally, revenues in 2025 will still be less than half of what they were in 2016.

Technical innovations help advertisers out of the crisis

The advertising market is closely linked to the economy as a whole and, with its fluctuations, also strongly influences the E&M growth rate. Last year, advertising revenues fell by 9.5 percent. B2B, radio and music, and OOH were hit hardest. But TV advertising also suffered, as major sporting events in particular, such as the European Football Championship and the Olympics, were postponed.

By 2025, the report predicts a recovery in the situation and a growth rate of 5.3 percent. The pandemic simultaneously accelerated the digital transformation and let the share of spending on online marketing rise to a new high of 58.7 percent. In the future, online advertising will continue to dominate and new developments such as 5G or virtual reality will further increase the interactivity, personalization and reach of this form of advertising.

New advertising opportunities are on the rise

Advertisers are increasingly struggling to reach young consumers through traditional media. This is why platforms with young users such as TikTok are suitable, as they hold increasingly greater potential thanks to new, advertising-friendly features. The same applies to video games, where the emerging e-sports scene is creating diverse sponsorship opportunities. Until 2025, online video marketing will remain the most important monetization model. However, revenues from cloud gaming are expected to grow strongly and video platform operators will promote this area relatively aggressively.

The report "Entertainment & Media Outlook 2021-2025" by PwC Switzerland provides detailed insights into the impact of the COVID 19 pandemic on the entertainment, media and advertising industries in Switzerland. It examines the affected sectors, classifies them and provides estimates for the further course up to 2025.