These brands were the most visible in the first half of 2020

Which brands had the highest visibility and which had the highest virality in the first half of 2020? Who was most visible in print advertising? Who was reported on most in online news and social media? Media Focus' brand trend provides answers to which brands were most visible in Switzerland.

Media Focus published the Brand Trend Switzerland on Thursday, the most comprehensive publication on overall communicative visibility in the Swiss brand landscape.

Key Facts:

- Visibility 2.4 billion: Ø 4.6 million per fire

- In the first half of 2020, the total measured visibility of the 523 brands is 2.4 billion gross francs.

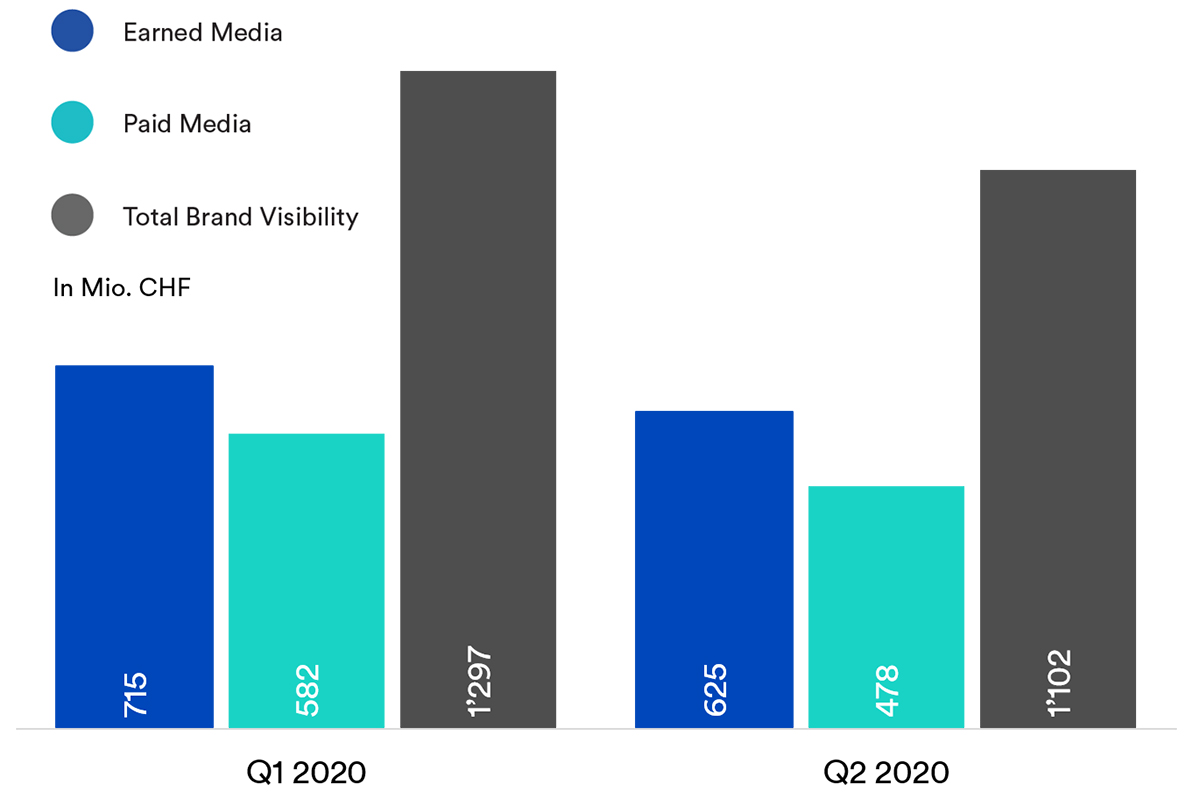

- Corona crisis noticeable in second quarter

- In the first quarter, total visibility was already around 14 percent below the previous year's level. In the second quarter, the decline amounts to 28 percent.

- Coop & Migros responsible for 12 percent of visibility of all Swiss brands

- The top sector, Retail & Food, achieves an impressive total visibility of 555 million gross Swiss francs. This corresponds to around 23 percent of the visibility of all sectors in the Swiss advertising market.

- Brand visibility: 56 percent not controllable

- Paid visibility (44 percent) is below earned visibility (56percent) in H1 2020.

- As in 2019: Retail trade & vehicles most visible sectors

- At 310 million, the Vehicles sector achieves the greatest earned visibility. Retail & Food generates the highest advertising pressure with 356 million.

- Only cleaning sector in positive territory

- The cleaning industry can noticeably increase the industry visibility in the first two quarters of 2020 compared to the previous year. The paid-earned ratio is very one-sided, with 94 percent paid visibility.

- Q1 vs. Q2: Strong differences between the sectors

- The high overall visibility of the retail sector is almost identical in Q1 and Q2 (+1 percent). The biggest increase compared with the starting quarter was in beverages in Q2, with an increase of 16 percent. The most significant decline was recorded by personal supplies (-52 percent).

Total Industry Visibility: Vehicles still on top

A look at the total industry visibility shows that the vehicles sector is the undisputed leader in earned media presence. In terms of paid visibility, the vehicle sector only has to admit defeat to Retail & Food. The Fashion & Sports sector has a similar paid-earned ratio to the automotive sector. Retail & Food achieves the highest total brand visibility due to the strongest advertising pressure and the third-highest earned media value of all sectors.

Top 10 Brands Visibility: Coop beats Migros

The ten most visible brands account for around a quarter of total brand visibility in the Swiss advertising market. In 2019, Coop was already ahead of its big competitor Migros in terms of total visibility at the halfway point of the year. At the end of the year, however, Migros was just ahead. It is interesting to note that while 81 percent of Coop's brand visibility is achieved through paid media, the figure for Migros is only around 52 percent.

Credit Suisse takes the bronze medal. Alongside UBS in 5th place, it is one of two representatives of the financial sector in the top 10. SBB is ranked 4th between the two big banks.

With VW (rank 7), Mercedes (rank 8) and BMW (rank 10), all scoring mainly with deserved visibility, three car manufacturers make it into the ranking. Swisscom in 6th place and Apple in 9th complete the ranking.

Top 10 Brands Virality: BMW overtakes Nikon

The virality ranking is in the hands of two types of companies: On the one hand, six car manufacturers are represented, and on the other, three camera manufacturers. Why is that? Cars are popular subjects and stimulate discussion. In addition to virality, this is also reflected in the extraordinarily high earned share of the automotive sector. Camera manufacturers, on the other hand, benefit greatly from customers who supplement their photos and videos with links and hashtags to the camera manufacturers.

As in the previous year, the measured virality values across brands are significantly higher in the starting quarter than in the second quarter of the year.

Nike also makes it into the virality ranking for the second time. In addition to its high virality values, the sporting goods manufacturer is also characterized by a strong predominance of earned media over paid media.

Battle of Brands and Twin Analysis

As in past editions of Markentrend Schweiz, Media Focus has once again directly compared two industry rivals in three "Battles of Brands," each in terms of brand visibility. This time, the "Twin Analysis" highlights the strategic twins of discount grocer Denner - brands that have a similar distribution of visibility across all earned and paid media.

Battle of Brands: V-Zug vs. Electrolux

Digital & Household: 31 Brands

Two competitors in the household electronics sector, the Swiss company V-Zug and the international giant Electrolux, have almost identical overall visibility. Only just 0.1 million gross francs lie between 15th (V-Zug) and 17th (Electrolux) place in the Digital & Household sector ranking.

V-Zug has a good twice as high earned visibility as Electrolux. Electrolux almost makes up for the resulting difference of 0.4 million with its higher paid visibility. The Paid-Earned ratio for both competitors is very one-sided in favor of Paid Media. The bottom line for total visibility is 4.6 million gross Swiss francs for V-Zug and 4.4 million gross Swiss francs for Electrolux.

Both V-Zug and Electrolux show clear potential for improvement in the earned area. While Electrolux is a frontrunner in TV advertising (rank 3) and out-of-home (rank 11), it ranks between 20 and 29 on all earned media channels. V-Zug shows a similar picture, with top 10 placements in print, TV and out-of-home advertising and ranks beyond the 20 mark on earned media channels.

Battle of Brands: Adidas vs. Nike

Fashion & Sport: 43 Brands

The comparison of the direct competitors Adidas and Nike is always exciting. In the overall market, Nike, with a visibility of 6.6 million gross francs (rank 88), is just ahead of Adidas with 6.1 million gross francs (rank 96). Within the fashion & sports sector, this means rank 6 (Nike) and rank 7 (Adidas).

As is common in the industry, both competitors achieve the majority of their brand visibility through earned visibility. While the Paid-Earned ratio at Adidas is at the one-sided ratio of 5:95, the trend towards Earned Media at Nike is also very clear at 7:93.

Nike is ahead of Adidas in the paid channels print, TV and Internet. Adidas, on the other hand, is strong in the earned area, especially in valuable print reporting.While Adidas is one rank ahead of Nike in Influencer, it is the other way around for online news. Also striking is Nike's first place on social media, which testifies to the brand's high virality.

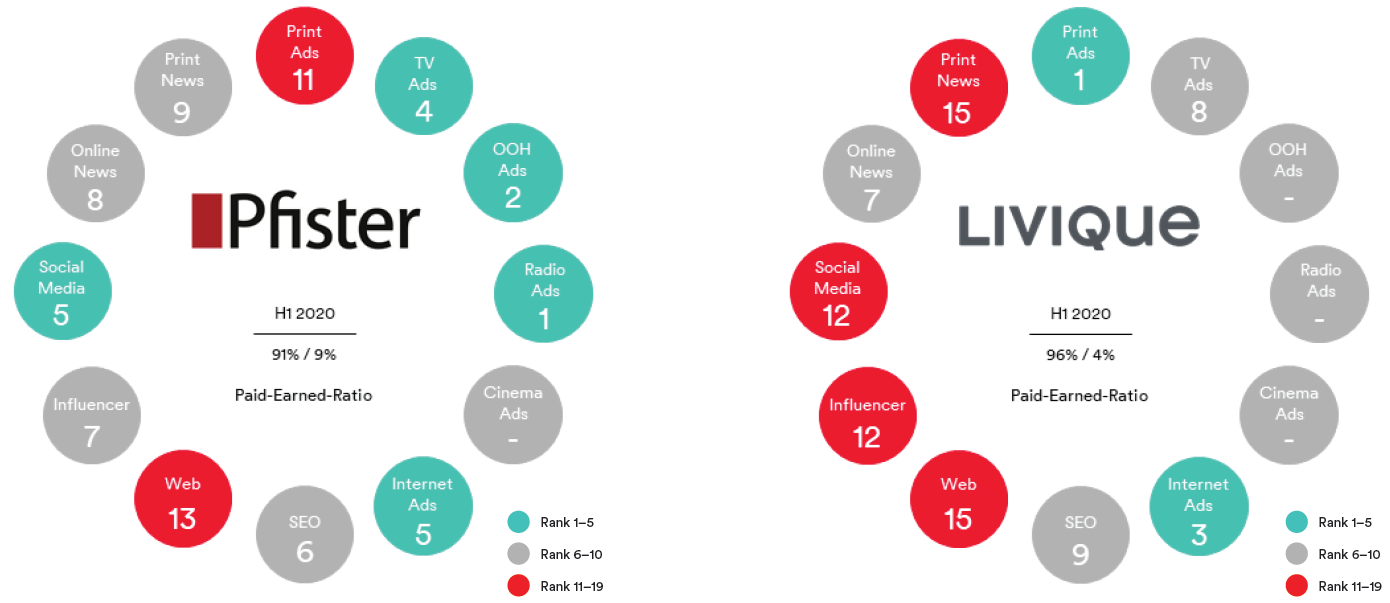

Battle of Brands: Pfister vs. Livique

Building, Industry, Furnishing: 19 Brands

With a lead of 0.5 million gross francs, Livique achieves slightly higher overall visibility (7.2 million) than its direct competitor Möbel Pfister (6.7 million). Both furniture stores make it into the top 5 most visible brands in the sample. Livique is in 3rd place, while Möbel Pfister is in 4th place.

Around 28 percent of total visibility in the Construction, Industry, Furnishings sector is generated by earned media, while paid visibility accounts for around 72 percent. Both Livique and Möbel Pfister are well below the industry average, with earned shares of around 4 and 9 percent respectively.

A look at the individual channels shows that Pfister is strong in the paid area in TV, radio, out-of-home and Internet advertising. The only area where there is still room for improvement is print advertising, where it ranks 11th. In the earned area, Pfister achieves the best rankings with influencers and on social media.

Livique, on the other hand, occupies podium positions in both print and Internet advertising. In online news, the company is also in a strong 7th place. Apart from SEO and Online News, Pfister lags behind Livique in all earned channels.

Twin analysis first half of 2020: ZKB

Omnichannel Mix Twins

The Volvo and Opel car brands show a comparable distribution of total visibility across the individual channels as ZKB. The percentages of TV advertising, print and online news are particularly similar.

Paid-Earned-Ratio Twins

When looking at ZKB's paid-earned ratio, Jaguar stands out as a strategic twin. The ratio is identical at 37:63, while the total visibility is around 3 times smaller. Online fashion retailer Asos also has a similar ratio between paid and earned visibility.

Paid Mix Twins

The sample does not show a confusingly similar paid distribution to that of ZKB. At Apple, the shares look similar - but TV is even more in the foreground, while print receives less attention. At C&A, only the TV share is at a similar level.

Earned Mix Twins

ZKB's earned visibility is primarily made up of mentions in print and online news and, to a small extent, social media mentions. BP and Daihatsu, a representative of the energy sector, and a car brand show similar distributions.

Omnichannel Earned & Paid in the first half of 2020

.png)