Germany, Austria, Switzerland: First advertising print comparison

For the first time, Nielsen Germany, Focus from Austria and Media Focus Switzerland jointly presented data on the gross advertising market in the DACH region. The analysis focused on advertising behavior in traditional and digital media (display) in the respective markets during the Corona pandemic.

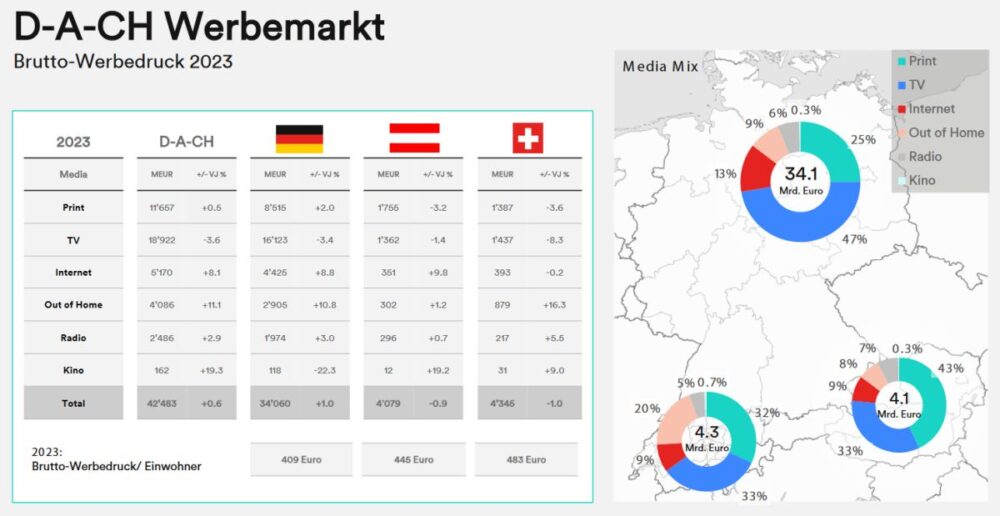

Even though the countries are linked by the same language and the market researchers use the same media coverage as a basis - print, out-of-home, TV (excluding pay TV), radio, Internet (display marketer statistics) and cinema - the analysis revealed some exciting differences and findings.

Clear winners - and clear losers

While the gross advertising market in Germany will grow by nine percent between 2019 and 2021, the increase in Austria will be much lower at three percent. In Switzerland, on the other hand, the total volume fell by five percent - with a significant cut during the pandemic year 2020. There are clear winners in the various advertising media, but also losers :

- Winner Internet: Up 23 percent in Germany, up 20 percent in Austria, up 26 percent in Switzerland

- Winner TV: Up 12 percent in Germany, up 14 percent in Austria, but down 13 percent in Switzerland

- Loser Cinema: Down 72 percent in Germany, down 67 percent in Austria, down 59 percent in Switzerland

Print losers: Stagnation in Germany, minus 5 percent in Austria, minus 7 percent in Switzerland - Out of Home and Radio are in the medium range

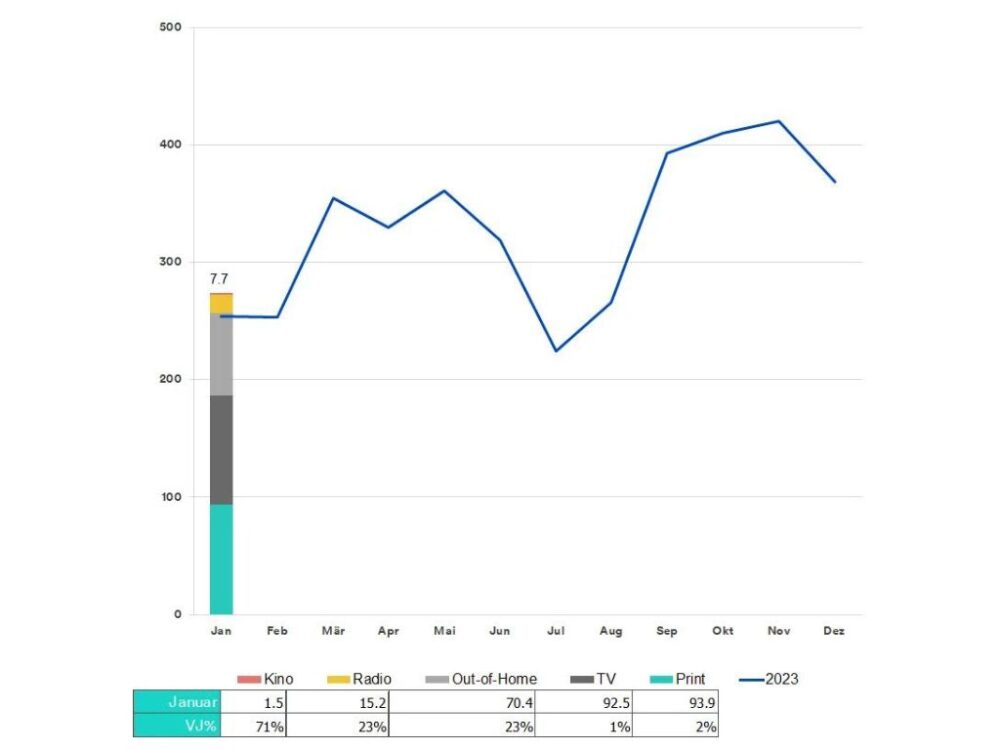

In addition, the experts took a closer look at the first half of 2022 in order to gain initial insights for "Fast Post Corona" to maintain. While all advertising media saw slight increases, the first half of the year brought cinema in particular a strong plus in terms of gross advertising print. In Germany and Austria, an increase of more than 1,000 percent was recorded compared to the previous year, while in Switzerland it was an increase of 774.2 percent. One of the reasons for the strong increases in this category is that during the lockdowns, cinema advertising spending had almost completely collapsed due to the pandemic-related closures. Now, with the return to "New Normal" and the accompanying reopening of cinemas, there was a huge increase in gross advertising expenditure.

"Extremely interesting comparison"

Commenting on the results, Tina Fixle, Chief Analytics Officer at Media Focus, said: "It was extremely interesting to take a closer look at the gross advertising market figures for the DACH region together with our German and Austrian colleagues for the first time. The countries show some differences, but also similarities. Our analysis should be a good support for advertisers when planning their future campaigns - both regionally and across countries in the D-A-CH region."