Apple Pay launched in Switzerland

The Apple Pay mobile payment service has been launched in Switzerland. This creates new competition for domestic contactless payment offerings such as the Twint and Paymit payment apps or the Bellamy payment watch from Swatch.

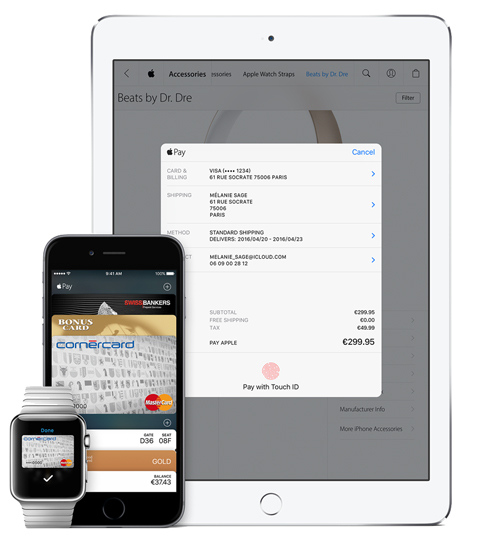

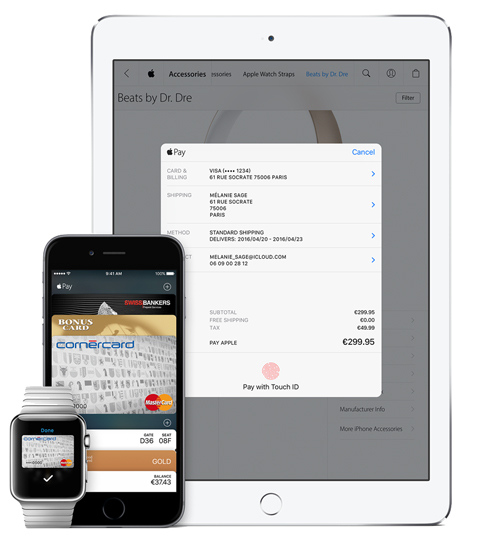

After the UK, Switzerland is the second country in Europe where payments can be made with Apple Pay. And this is no coincidence. With a market share of just under 50 percent, Switzerland is a true iPhone country. Customers of the credit card companies Visa and Mastercard who have a card from the card issuers Bonuscard, Cornèrcard and Swiss Bankers can initially pay with Apple Pay, as Apple announced on its website. The credit card must be deposited with Apple Pay. After that, the cell phone will work, as in the case of contactless payment with a credit card. The service will therefore be able to be used at all cash registers equipped with radio terminals of the Near Field Communication standard (NFC): In addition to Migros and Coop, this is also the case at Aldi, Lidl, Spar and Valora's Kiosk and Avec stores. In addition to the iPhone, payments can also be made with the iPad and the Apple Watch. The prerequisite is that you have at least an iPhone 6, an iPad Pro, Air 2, mini 3 or 4.

Contactless payment on the rise

According to Stefan Holbein, Country Head of Visa Europe Switzerland, Switzerland is virtually predestined for payment via smartphone. In May, 11.3 percent of all Visa transactions in this country were processed via contactless. A year ago, this figure was only half as high. Today, two-thirds of all Visa terminals in Switzerland are already equipped with NFC technology. By 2020, the standard will be available for all terminals.

Other technologies for competition

The market entry of Apple Pay is likely to be a litmus test for the Swiss payment app Twint, which will be merged with the competing product Paymit in the fall. Although the latest models have NFC on board, Apple has so far denied app developers access to the interface. The manufacturer only allows Apple Pay to communicate via NFC. Therefore, Twint and Paymit will have to resort to other technologies until further notice. With Paymit, for example, a QR code must be scanned. With Twint, payments are processed via Bluetooth at a separate terminal at the store checkout. Nevertheless, Twint does not have to hide from Apple Pay. The merged service is backed by UBS, Credit Suisse, Postfinance, Raiffeisen and ZKB, the five largest Swiss banks, Coop and Migros, the two largest retailers, and Swisscom, Switzerland's largest telecommunications provider. (SDA)