These brands were the most visible in Switzerland in 2019

Which brands had the highest visibility in 2019, which had the highest virality? Who was most visible in print advertising? Who was reported on the most in online news and social media? Media Focus' brand trend provides the answers.

Media Focus published the Brand Trend Switzerland on Thursday, the most comprehensive publication on overall communicative visibility in the Swiss brand landscape.

Key Facts:

- Visibility 6.0 billion.: Ø 11.0 million. per brand

- The total measured visibility of the 523 brands is 6.0 billion gross francs in 2019.

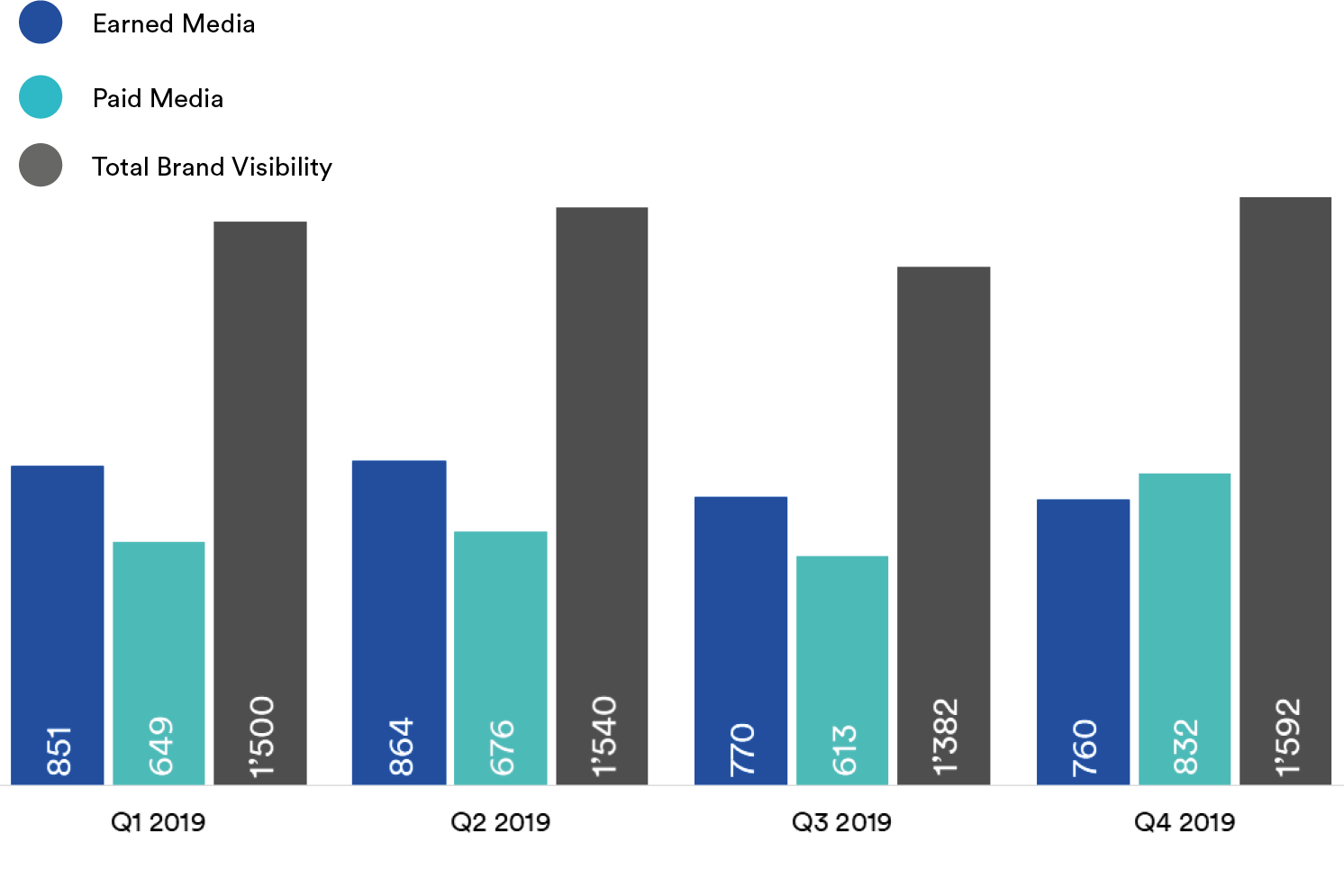

- Visibility evenly distributed over quarters

- The percentage shares of the 4 quarters in the total visibility achieved for the year all range between 23 and 26 percent. In Q4, the highest percentage of annual visibility was achieved at just over 26 percent.

- 50 brands = 50 percent of brand presences

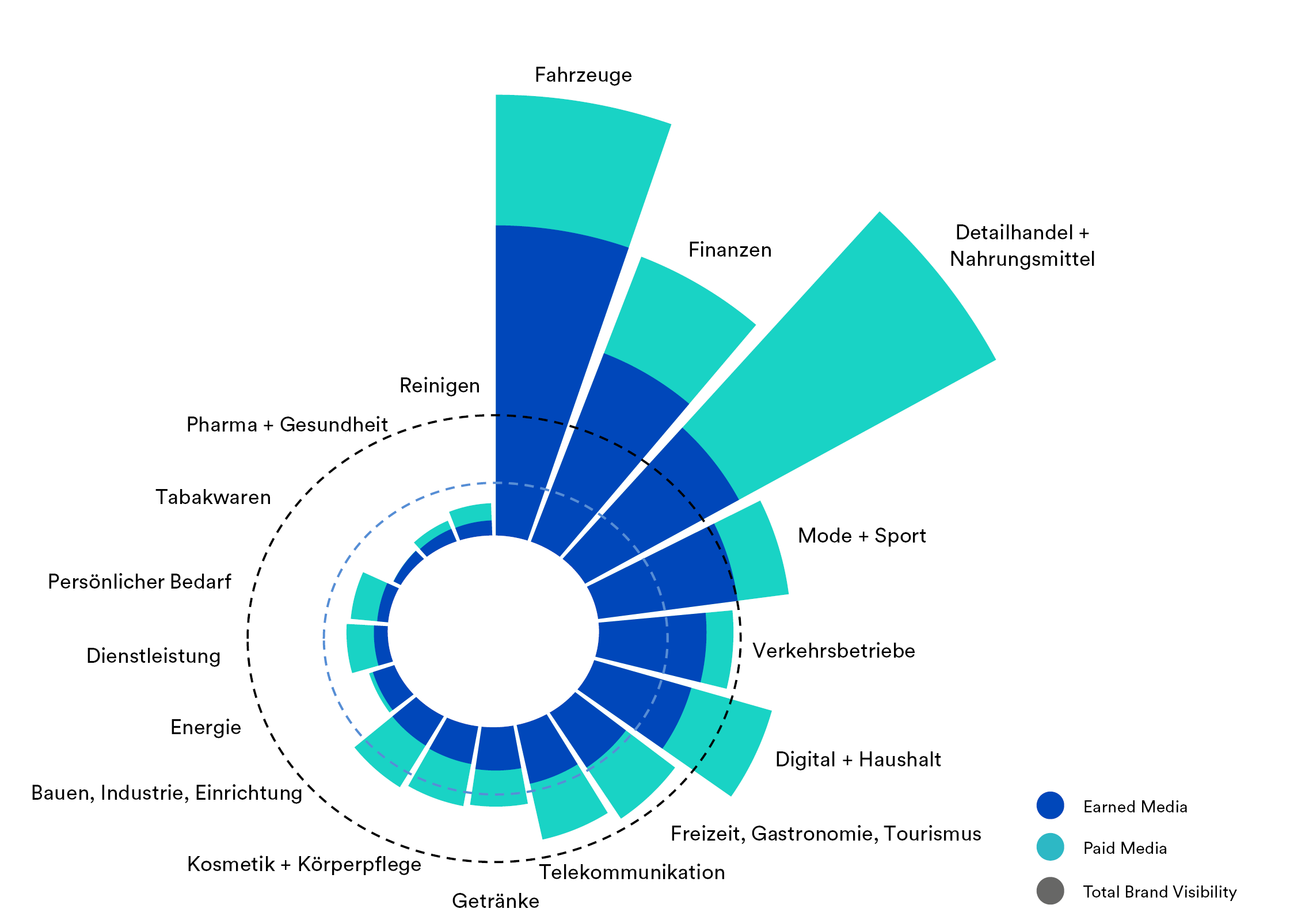

- The three largest sectors, Retail & Food, Vehicles and Finance, generate over half of the total visibility.

- Brand visibility: 54 percent not controllable

- Earned visibility is slightly higher than paid visibility in 2019. The ratio between advertising and media presence is 46:54.

- Most visible industries: Retail & Vehicles

- The Vehicles sector achieves the greatest earned visibility with 805 million. Retail & Food generates the highest advertising pressure with 795 million gross Swiss francs.

- Christmas advertising pushes paid visibility in fourth quarter

- Only in the fourth quarter is paid brand visibility in the overall market higher than earned visibility. This is due to the advertising campaign at Christmas time (+36% compared to the third quarter).

- Thirsty: drinks in the summer high

- The beverage sector generates 62 percent of total viewability in Q2 and Q3, with over one-third of annual viewability generated in the pre-summer months of Q2. This trend can be seen in both Paid and Earned.

Total Industry Visibility: Vehicles on top

A look at the Total Industry Visibility shows: The "Vehicles" sector is the undisputed leader in earned media presence. The "Retail & Food" sector is the most visible sector overall due to the high advertising pressure. And the telecommunications and beverages sectors have an almost identical paid-earned ratio.

Top 10 Brands Visibility: Migros remains at the top

Migros was able to defend its top position in the visibility ranking from the previous year. It is closely followed by its eternal rival Coop, which achieved higher overall visibility than Migros in the second half of the year. Overall, the two retail giants are almost on a par. While Coop has the lead in the paid area, Migros can score points with earned media.

With a large gap to the top 2, SBB secured the bronze medal thanks to the third-highest earned share of all brands. Swisscom comes in fourth place, closely followed by UBS.

The top 10 are completed by other brands from the automotive industry, Credit Suisse and Apple. Unsurprisingly, the two big banks UBS and Credit Suisse achieve the highest earned shares. In the wake of the Iqbal Kahn affair, however, many of these mentions have negative connotations. The 10 most visible brands account for just under 24 percent of the visibility of the entire Swiss brand sample.

Top 10 Brands Virality: Nikon ahead thanks to social media

The three most viral brands of 2019 are Nikon, BMW and Audi. Despite a weak start to the year with 122nd place in the first quarter, Nikon secured the highest virality of all brands over the year as a whole. This is primarily due to the frequent mentions in social media in connection with images shot with Nikon cameras. The other two camera manufacturers, Canon in fifth place and Sony in ninth place, also benefit from such social media posts.

A full 6 of the 10 most viral brands of the year are car brands. Particularly in Q1, in the run-up to the Geneva Motor Show, they achieve high levels of virality - before virality drops again significantly in the second quarter. The exception is VW: the Wolfsburg-based group moves between 7th and 11th place in the ranking across the quarters.

The only brand in the top 10 that is not associated with either cars or cameras is sporting goods giant Nike in 8th place.

*Since Q4 2019, additional virality parameters have been included in the calculation of the virality value. This results in higher virality values across all sectors and brands in Q4. Accordingly, Q4 has the greatest influence on the position in the annual ranking.

Battle of Brands and Twin Analysis

As in past editions of Markentrend Schweiz, Media Focus has once again directly compared two industry competitors in three "Battles of Brands" each in terms of brand visibility. The "Twin Analysis" this time highlights the strategic twins of discount grocer Denner - brands that have a similar distribution of visibility across all earned and paid media.

Battle of Brands: Samsung vs. Huawei

Industry "Digital and household

Both Samsung (2) and Huawei (3) occupy podium positions in the visibility ranking of the "Digital and Household" sector. Samsung has a cushion of around 16 million Swiss francs on the Chinese runner-up. The only industry representative with even higher visibility than Samsung is Apple.

Samsung will generate advertising pressure of 30 million gross Swiss francs through Paid Media in 2019. This value is almost identical to the visibility earned through Earned Media (29.4 million Swiss francs). Huawei generates only half as much advertising pressure in Paid as Samsung (14.6 million Swiss francs), but is on par with Earned (30.1 million Swiss francs). It should be noted here that the lively reporting on Huawei in connection with the topic of 5G was very controversial and often critically discussed.

It is noticeable that both Samsung and Huawei still have potential for improvement, mainly in the areas of SEO and Internet Ads. While Samsung is also the industry's No. 1 in the area of cinema advertising, Huawei is foregoing both cinema advertising and radio advertising in 2019.

Battle of Brands: Pfister vs. Interio

Branch: "Building, Industry, Furnishing

In terms of total visibility, Möbel Pfister (4th place) and Interio (7th place) are both in the midfield of the brand sample from the Construction, Industry & Furnishings sector. Pfister has a total visibility of 15.8 million Swiss francs in 2019, while Interio has a value of 13.8 million Swiss francs.

Both representatives achieve this visibility mainly through Paid Media, whereby the Paid-Earned ratio is clearly more one-sided at Pfister than at Interio. In absolute terms, Interio also achieves higher earned visibility (CHF 5.4 million) than Möbel Pfister (CHF 3.0 million). In the paid area, which is the main driver of total visibility for both competitors, Pfister is clearly ahead with 12.7 million Swiss francs compared to Interio's 7.2 million.

While Möbel Pfister excels mainly in traditional paid channels, Interio is strong in print news and Internet ads.

Battle of Brands: Ricardo vs. Tutti.ch

Branch: "Service

Ricardo takes first place in the ranking of the 10 most visible service brands in Switzerland. With a total visibility of 15 million Swiss francs, the online auction house relegates its rival Homegate by a hair's breadth to second place. Switzerland's largest online flea market, Tutti.ch, occupies ninth place (3.1 million Swiss francs).

The paid-earned ratio is similar for both marketplaces: the lion's share of brand visibility is achieved through paid advertising, confirming the industry trend - only 2 of the 10 brands analyzed achieve higher visibility through coverage than through paid advertising.

Apart from social media (rank 6), industry leader Ricardo is among the 5 most visible brands in the sample on all channels used. Tutti, on the other hand, is only in the top 5 in the earned media channel Influencer and in SEO.

Twin analysis 2019: Denner

Omnichannel Mix Twins

Barilla as well as SportXX show a similar distribution of visibility across all earned and paid media compared to Denner.

Paid-Earned-Ratio Twins

Denner's paid-earned ratio is almost identical to that of discounter competitor LIDL. Škoda also achieves a comparable paid-earned ratio in 2019, with a similarly large overall visibility.

Paid Mix Twins

Similar to Denner, meat producer Bell and optician McOptic also focus on classic media for paid visibility. TV, print, and outdoor advertising make up the bulk of the advertising pie.

Earned Mix Twins

Denner's earned visibility is primarily made up of mentions in print and online news portals. Within the industry, the shares of earned channels are similarly distributed at Nestlé, and outside the industry at BNP Paribas.

Omnichannel Earned & Paid 2019

Top 10 Earned

Top 10 Paid