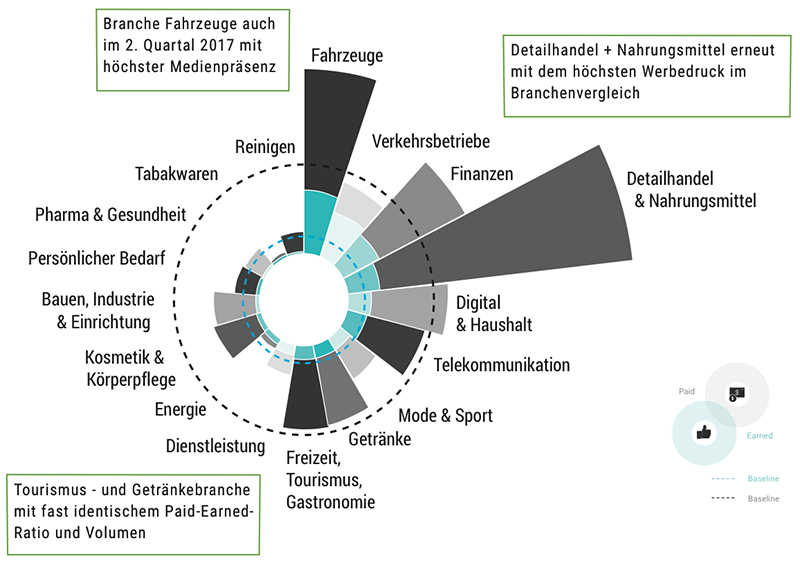

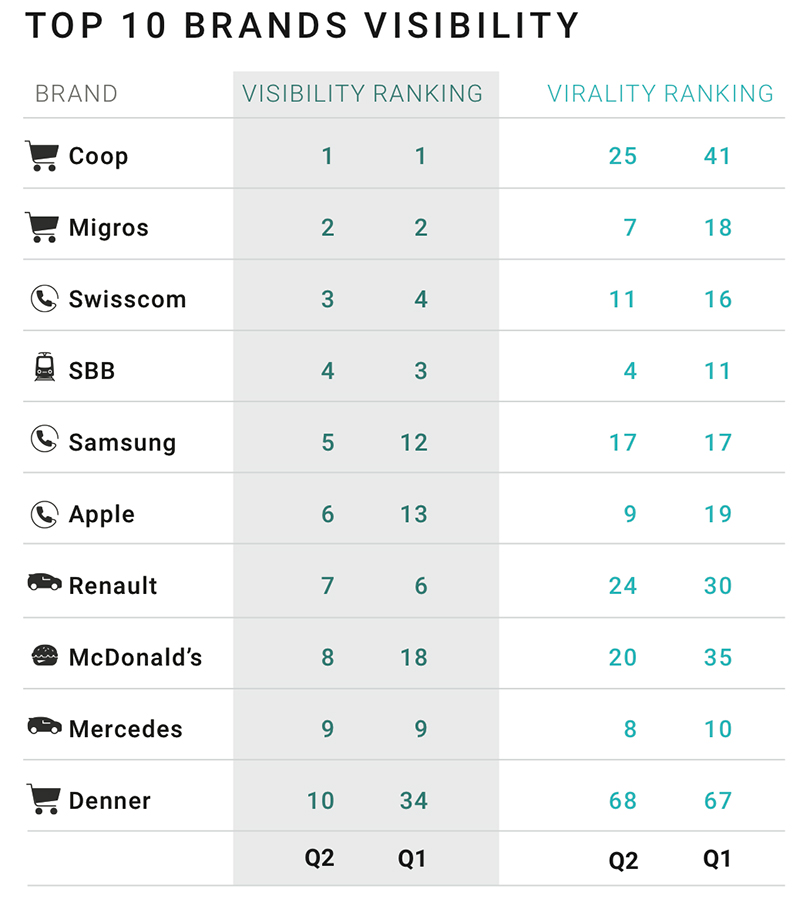

Coop remains Switzerland's most visible brand in second quarter

The Swiss brand trend from Media Focus is entering its second round. New, including a time series comparison and six exciting "Battles of the Brands": Aldi vs Lidl, Apple vs Samsung, Rolex vs Omega, Renault vs Toyota, UBS vs CS and Visana vs Sanitas.

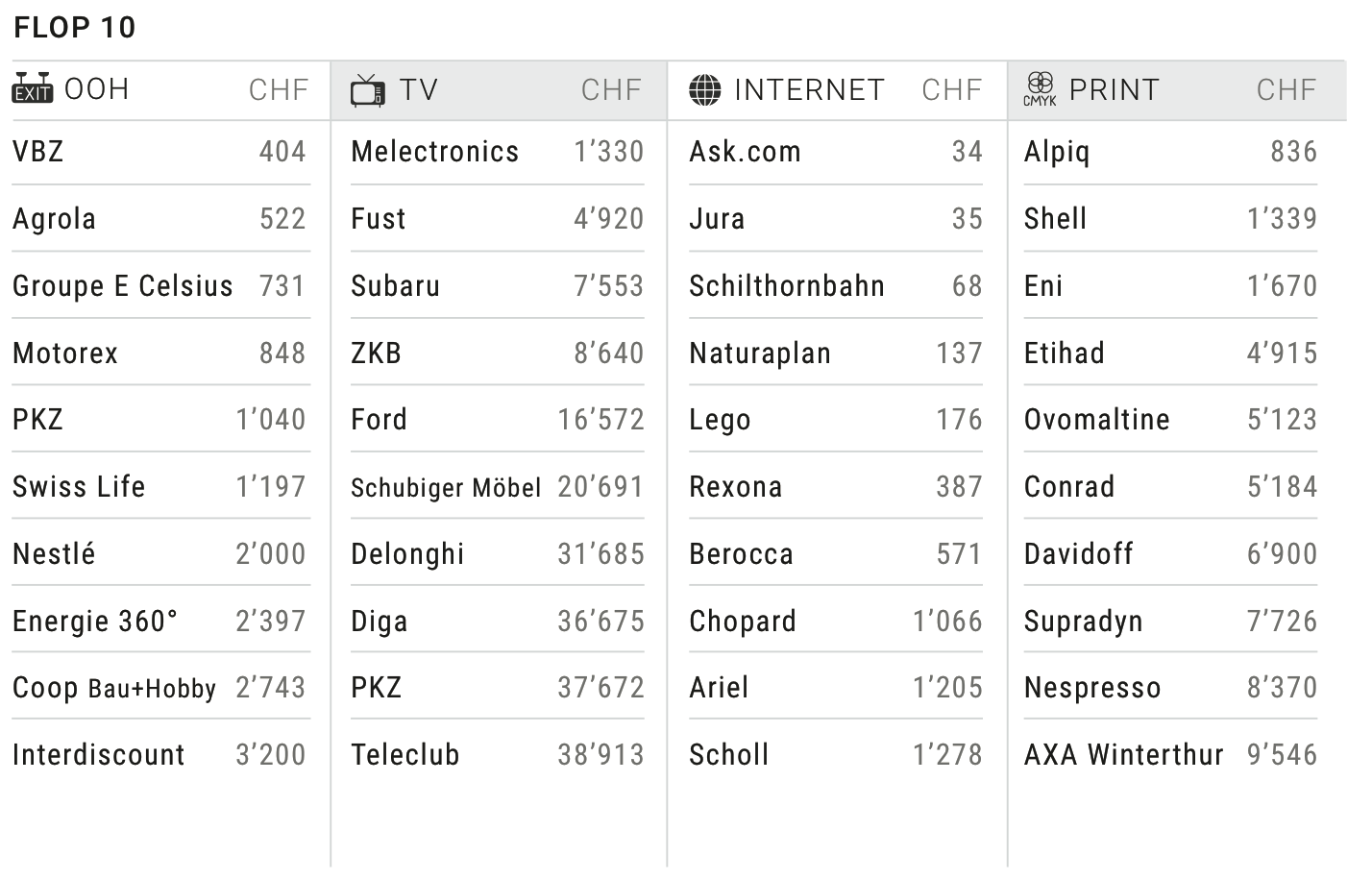

The Coop brand defended its top position as the most visible brand in the Swiss market sample (Visibility Earned & Paid Media) in the second quarter of 2017. However, rival Migros was able to close the gap thanks to a broad-based poster campaign. Smartphone giants Samsung and Apple as well as McDonald's made the leap from the top 20 to the top 10 in this quarter. most visible brands. Denner even makes it out of the top 30 and into 10th place, while the automotive industry continues to be represented by Renault and Mercedes, although Ford and VW leave the top 10.The discounter Aldi and the Kinder brand also just failed to make it into the top 10.

In the top 10 of the most viral brands much has changed compared to the previous quarter. Only four out of ten brands made it back into the top 10, with the two big banks Credit Suisse and UBS holding their own among the three most viral brands in Switzerland. In this quarter, Cedit Suisse is just ahead of UBS, relegating it to 2nd place. Nestlé is the first newcomer in third place, and the food group is also focusing on financial topics. With the "sweet" idea of rewarding its train drivers for stopping on time with chocolate, SBB was able to increase its virality and climb into the top 10.

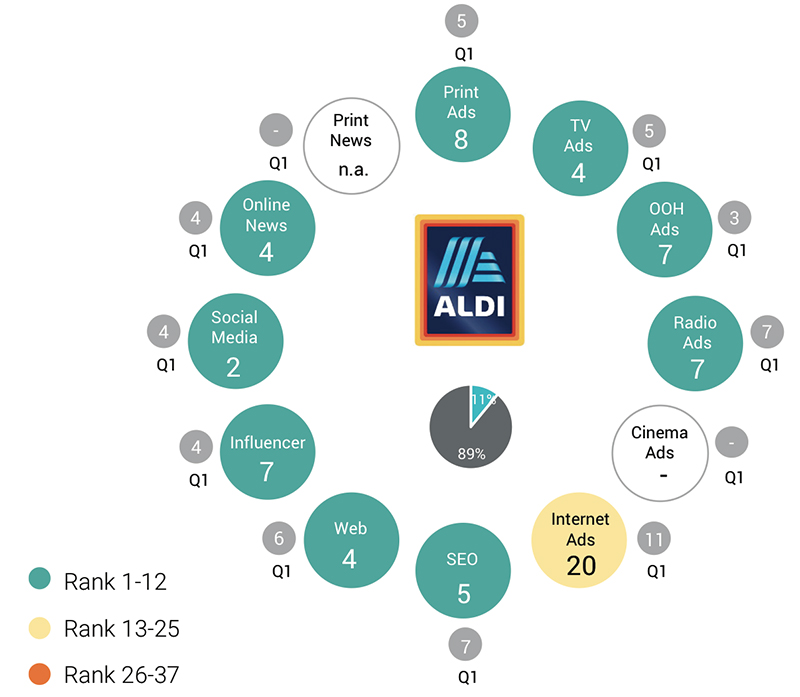

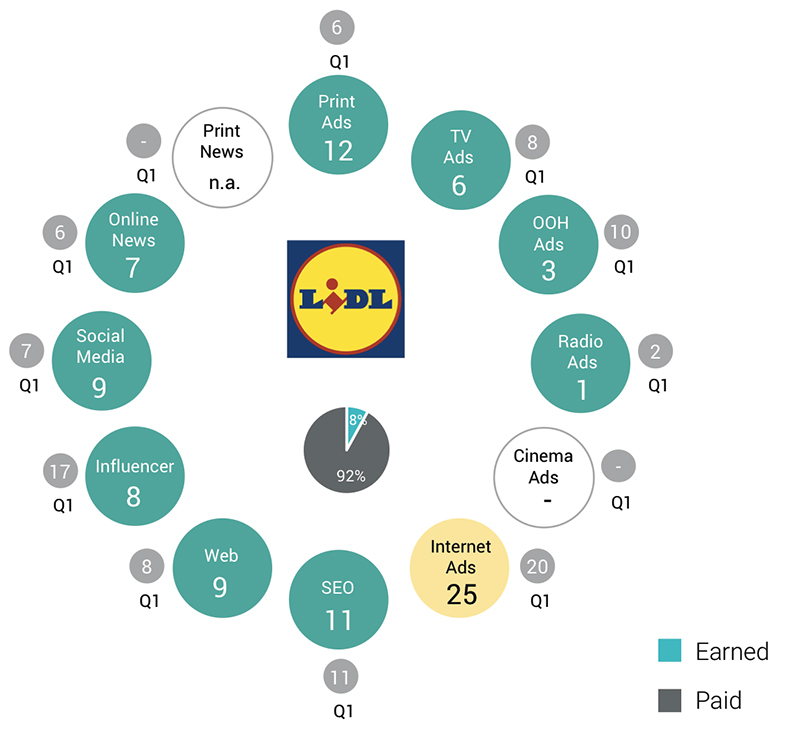

Battle of Brands: Aldi vs Lidl

In the combined sector Retail + Food The two Swiss giants Migros and Coop dominate the market. Together, they account for around 55% of the total brand visibility of the entire industry. However, the other brands in the heavily paid media-heavy sector (paid/earned ratio: 90/10) are also highly visible in the Swiss market. McDonald's, Denner, Kinder, Aldi, Lidl and Coca Cola are among the top 20 brands.

Aldi and Lidl behave in line with the industry trend and buy a large part of their visibility. Aldi's paid media share is 89%, while Lidl's is as high as 92%. Overall, the two competitors are very close to each other, but their strategies differ significantly.

Lidl pursues an extensive out-of-home strategy, supplemented by regional penetration through radio advertising. Aldi, on the other hand, continues to invest a lot of money in traditional print media. However, TV remains the most important medium for both. However, this seems to be more worthwhile for Aldi than for Lidl when looking at earned visibility.

Overall, Aldi is ahead of Lidl in terms of earned visibility. The social networks are particularly noteworthy here. While Lidl is practically invisible, Aldi's strategy seems to be working better. People are talking about Aldi!

The Karaoke Karpool parody with the Aldi Chind George Clooney, the Coop Chind Gwen Stefani and the Migros Chind James Corden has been viewed over 200,000 times so far and has delighted the online community.

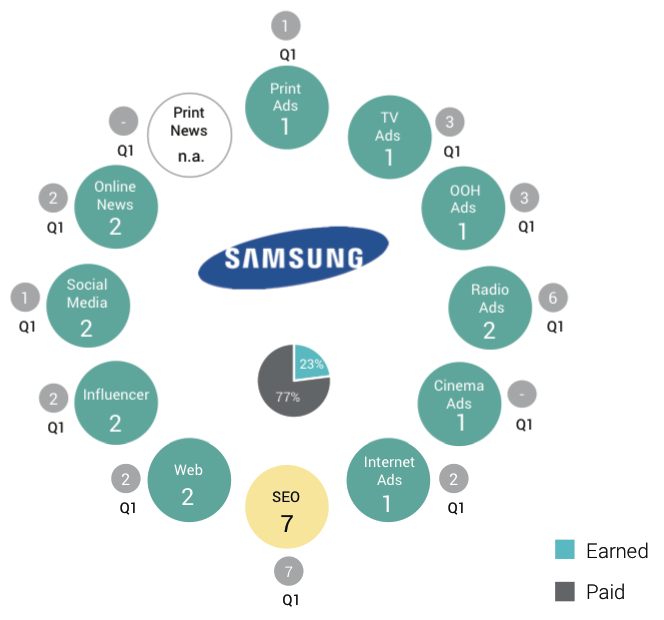

Battle of Brands: Samsung vs. Apple

Smartphone giants Samsung and Apple are battling it out in the industry. Digital + household are in a tough neck-and-neck race and claim the top two positions in the industry by a clear margin ahead of their rivals Sony and Nintendo.

With total brand visibility values of 13.9 and 9.6 million francs, it is not surprising that the electronics groups made the leap from the top 20 to the top 10 in Q2 2017, even across all sectors.

In the duel, it is ultimately the advertising presence that allows Samsung to emerge victorious. Thanks to the product launch of the Samsung Galaxy S8 and S8+ and the associated campaign covering all channels, Samsung has around twice as much gross advertising pressure as Apple. Samsung is advertising more aggressively in all channels.

Samsung even occupies the top position in print, TV, out-of-home, cinema and Internet advertising. Only in radio advertising is another brand - Universal Music - more present.

In the earned media sector, on the other hand, Apple is ahead on all channels with the exception of social media.

Apple's earned media visibility is around a quarter higher than that of its South Korean competitor. Topics that moved the web in this context included the launch of Samsung Pay in Switzerland, the introduction of the new iOS 11 beta version and the guesswork surrounding the new iPhone in particular and the future of smartphones in general.

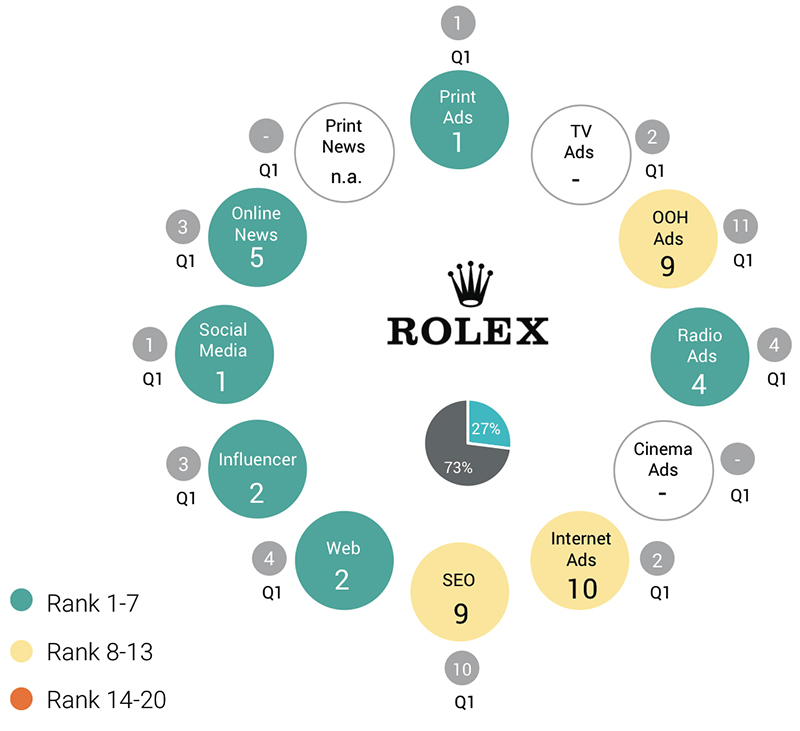

Battle of Brands: Rolex vs. Omega

Rolex relies in particular on print advertising, with only 6 percent of the budget of 1.6 million invested in other paid channels. At Omega, this figure is 33 percent.

Rolex is also clearly ahead of Omega in terms of earned visibility. Whether it's theft or the Bachelorette final, the brand is visible in connection with a wide variety of topics. Could a Bachelorette finalist possibly have been unmasked before the final simply because of his Rolex? Who knows, but Rolex is grateful for the additional media presence.

The luxury brand is particularly far ahead in the social media, influencer and web channels. The Rolex brand still has quite a bit of power reserve compared to its peers in the industry.

Battle of Brands: Renault vs. Toyota

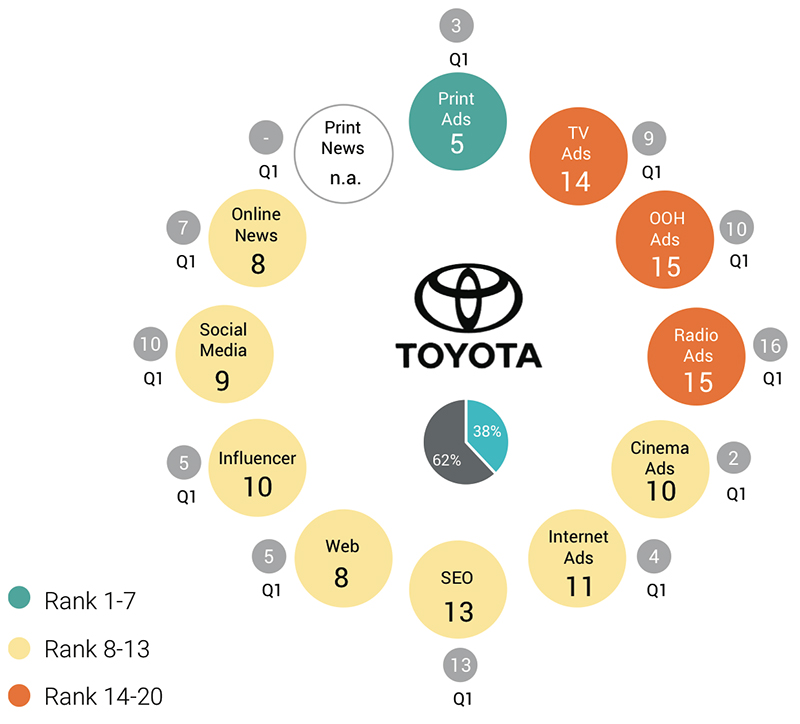

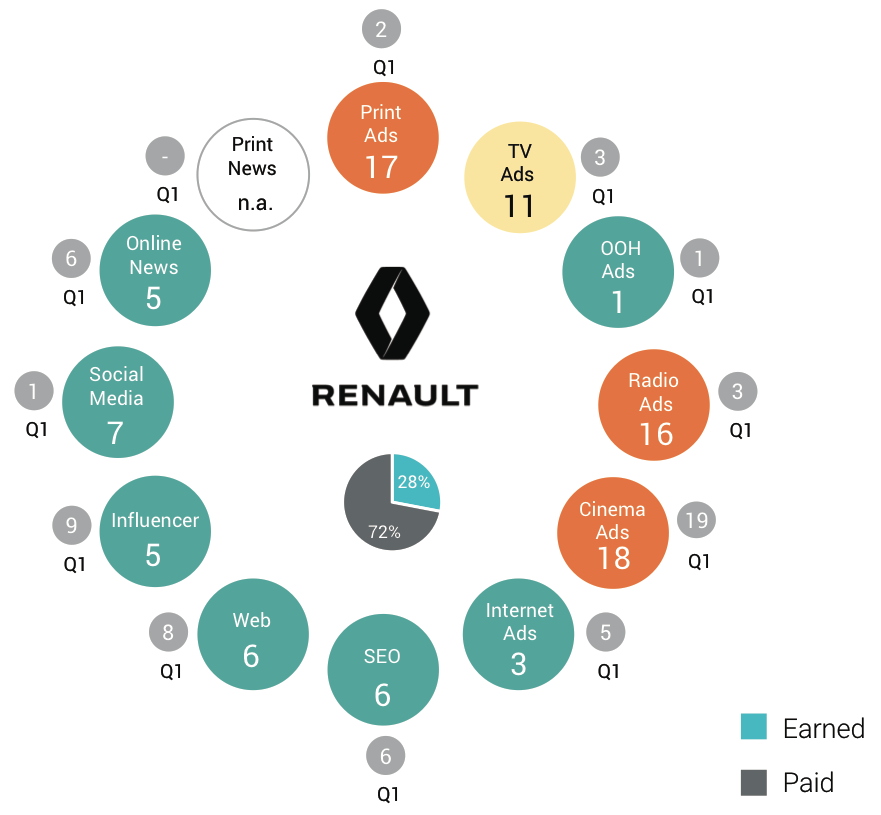

For the second quarter in a row, the French Renault takes pole position in the Vehicle industry and races past its German competitors Mercedes, VW and BMW. Toyota was still in 6th place in Q1, but only ranked 13th in the second quarter of 2017.

Renault's Total Brand Visibility value in the current quarter is more than twice as high as that of its Japanese competitor. In the first quarter of the year, Toyota still achieved a value that was around 60 percent of that of Renault.

This development is due to Toyota's more defensive advertising behavior. Toyota is reducing its print advertising by more than half, in line with the industry trend. Renault is also reducing its expenditure on print, as well as TV and radio advertising, but is investing more in out-of-home and internet advertising.

The French company is also ahead of the competition from Japan in the Earned segment - 2.5 million to around 1.5 million francs - and is therefore more visible than average across all Earned channels. Toyota, on the other hand, is only average compared to its competitors.

The same picture can be seen in the natural Google search. Renault finishes in 6th place, Toyota in 13th.

The ratio of paid and earned is more balanced at Toyota due to Renault's high advertising investments. Earned media accounts for 38 percent at Toyota and is well above the benchmark. Renault is slightly below average with 28 percent earned media.

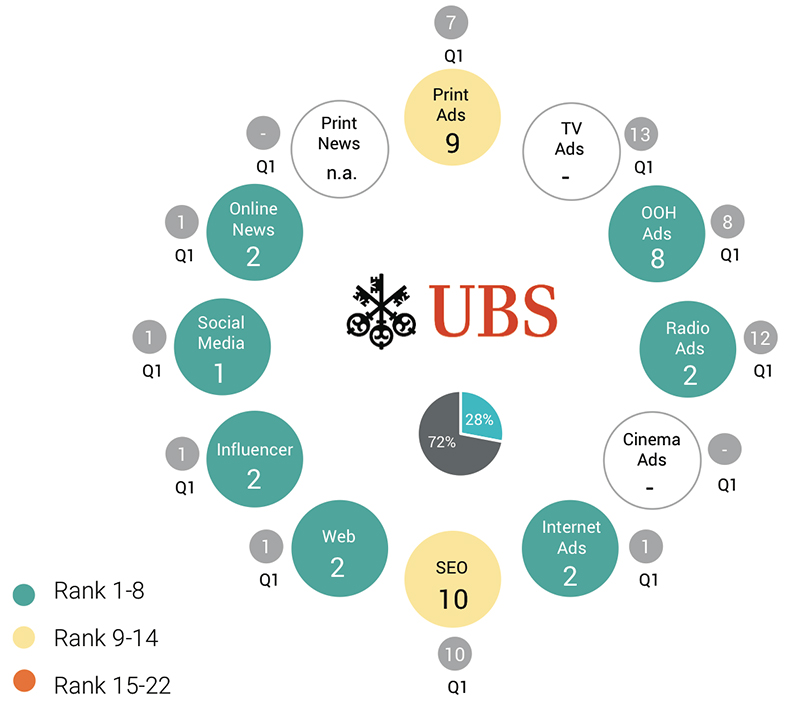

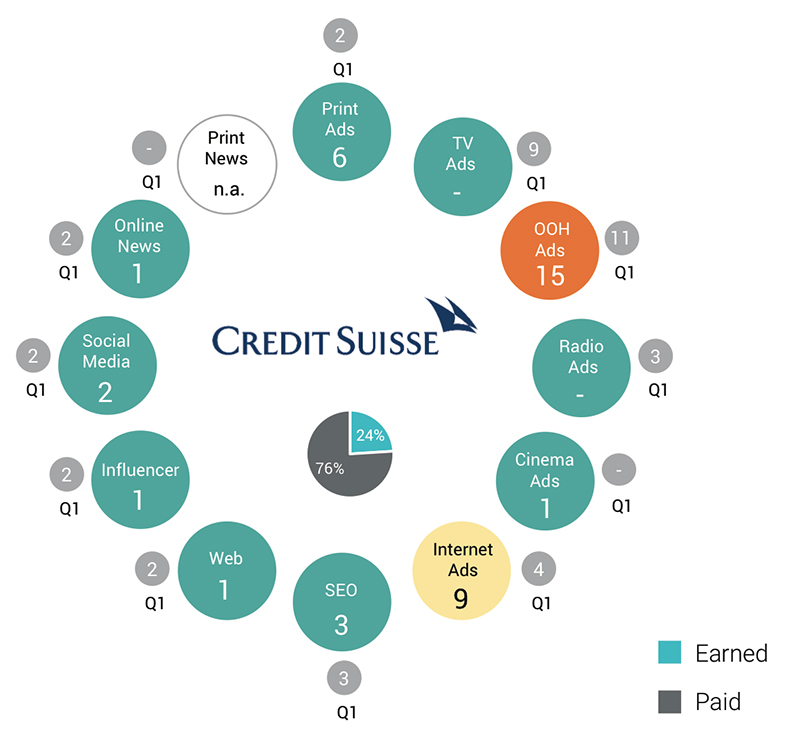

Battle of Brands: Credit Suisse vs. UBS

Credit Suisse must, UBS may - at least as far as analysts' forecasts for new money acquisition are concerned. In terms of communication behavior, the two are almost on the same level, so the target photo will have to decide in Q2.

In the assessment of overall visibility, UBS is only just ahead of Credit Suisse with just over 7.7 million. Differences can only be identified and evaluated when analyzing the omnichannel mix.

On closer inspection, however, you don't notice anything about having to. The paid channels are used with roughly the same budgets, although UBS ultimately sets itself apart here. CS is less present on the Internet, but invests in cinema to reach its target groups, where UBS takes the lead.

Conversely, UBS can be heard on the radio with a mini-budget, which CS saves. Credit Suisse invests only a third of its competitor's money in the out-of-home channel, and part of this money goes to print, where UBS lags behind.

In the earned media segment, on the other hand, Credit Suisse benefited from news articles. Reports on the Annual General Meeting in general and in connection with the Greenpeace campaign, as well as articles on the big bank's business, ensured media coverage in the second quarter - both positive and negative.

Otherwise, the tension between UBS and CS is comparable to the Mercedes-dominated Formula 1.

Battle of Brands: Visana vs. Santias

In spring, not only does nature awaken from its winter slumber, but health insurance companies also get back into the advertising swing of things. For a long time, health insurers limited themselves to advertising only in the fall before the change window.

However, this was apparently not enough. The pressure in the extremely competitive market is steadily increasing and a second advertising peak has been observed in spring for a good five years. This strategy, which was initiated by Groupe Mutuel, has already been followed by Visana for four years, and in 2017 Sanitas also joined the ranks of the spring bloomers.

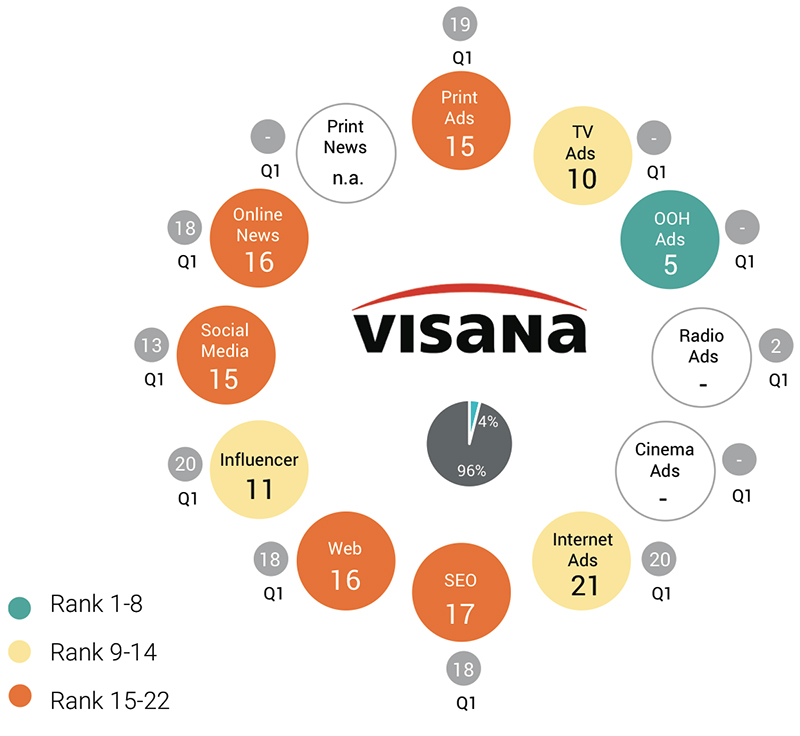

As far as the media mix is concerned, Sanitas and Visana focus on traditional media with a high reach, supplemented by online advertising. Here, search advertising predominates at Sanitas and display advertising at Visana.

With 8 times higher visibility in the paid media area, Visana is clearly ahead of Sanitas. Visana even outperformed the big banks in the out-of-home advertising channel and came fifth in the financial sector with above-average visibility.

However, Visana is unable to translate its advertising dominance over Sanitas into earned media presence. Here, Sanitas and Visana are neck and neck in 16th and 17th place in the intra-sector comparison. Sanitas is able to achieve a third of its total brand visibility via earned media, compared to only 4% for Visana.

Across all channels, paid and earned media, Visana is slightly below the industry average. Sanitas even brings up the rear.

Omnichannel Earned:

Omnichannel Paid: